Upholstery is among the most sought after category, followed by decorative accessories and mattresses

Having been involved on the product side of the business for so long — mostly case goods but more recently upholstery — it’s hard not to capture my attention with anything product-related.

That’s always been true both during and between market cycles as product is what has always driven this business.

So naturally when it came time to look over the data presented in our exclusive Consumer Insights Now research, the product segment obviously caught my eye.

In fact product is front and center with useful information about what categories people plan to buy in this second half.

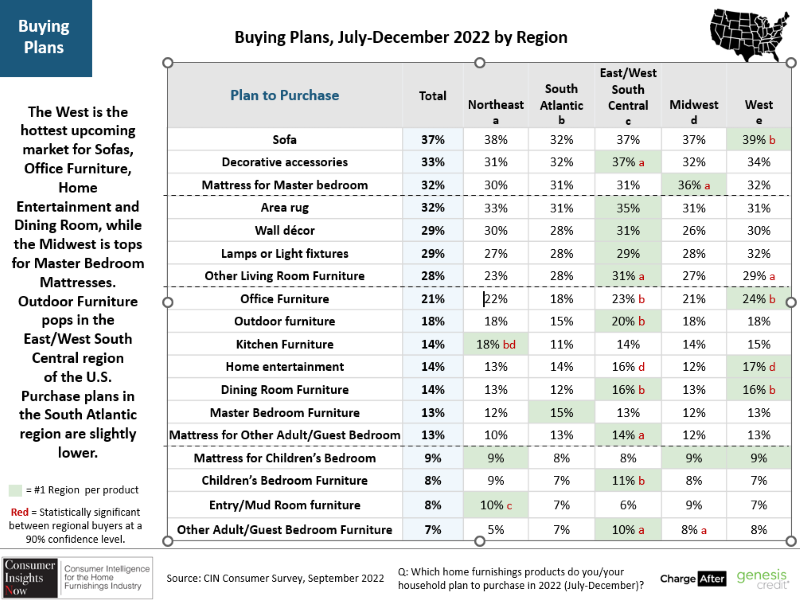

The number one category? You guessed it — upholstery with 37% of those surveyed planning to buy a sofa in the coming months. It was followed by decorative accessories at 33% and a mattress for the master bedroom and area rugs tied at 32%.

Wall décor and lamps followed, both tied at 29%, and then other living room furniture, at 28%, which can include anything from accent to occasional tables to go with sofas and other types of seating.

Case goods resources are probably fuming at this point because none of the aforementioned products — occasional and accent tables included — are big ticket items. But wait, the top 10 includes both office and kitchen furniture at 21% and 14% respectively, with outdoor furniture ranking at 18%.

Of course, home entertainment and dining room furniture could also feasibly be considered in the top 10 since they also tie at 14%. These are followed by bedroom furniture (13%), mattresses for the child’s bedroom, (9%) and children’s bedroom furniture (8%) and guest or second bedroom furniture (7%).

The data is revealing also when you consider that consumers between ages 18 and 41 will account for 72% of those who plan to buy furniture during the second half.

Thus the data shows the areas of the home and categories they believe are the most important during their young adult years. Upholstery and other living room furniture and accessories make sense as they are the parts of the home where they see themselves spending the most time. Accessories and rugs, the decorative elements that are the jewelry in the room also made sense as they are items that can easily be purchased on line as well as store for very little cash outlay.

Note too, that price and sale remain key factors in the buying decisions, with 70% and 60% respectively saying those factors drive the final purchase decision, along with style, design and look weighing in at 62%. So value remains king, a big part of which is affordability.

Also note that only 20% rated buying from a known or trusted manufacturer as a key part of the buying decision, which gives retailers an opportunity to tout their own brands as many are already doing.

Additional data shows that in order, quality, durability, style/design, color and type of fabric are among the top considerations for consumers, while manufacturer I know and trust, ability to customize, sustainability/eco-friendly product, uniqueness and storage functionality are among the lowest considerations.

What perhaps was a little unsettling, particularly for those in the category were the results for youth mattresses and youth bedroom, which ranked in the bottom part of the survey, at 9% and 8% percent respectively. With more than 70% of those planning to buy furniture in their prime child bearing and raising years, this is a curiosity as you might think they would be in the market for kids furniture. Perhaps having kids is the furthest thing from their mind at this point.

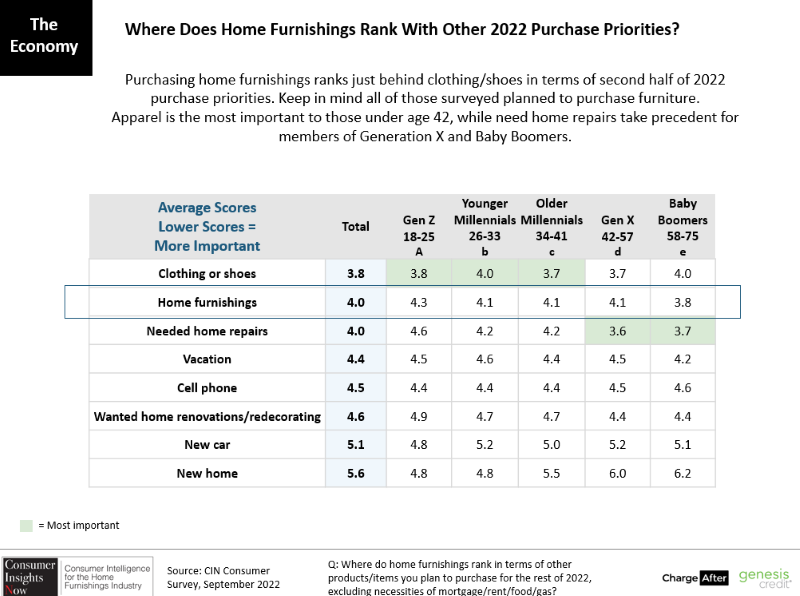

The good news is that furniture buying remains one of their most important priorities, coming in ahead of things like a new home, a new car, a new cell phone and even vacations. So furniture resources have reason to celebrate and a reason to market, with targeted messages aimed at younger consumers.

Who knows, maybe such marketing will even get them thinking of having children and buying youth furniture somewhere in their not too distant future.

The research will debut Sept. 12 with the full national survey of nearly 2,000 consumers to be followed by five successive regional reports.

All respondents are either the primary or joint purchase decision maker and the sample includes a mix of females and males, ages 18 to 74 and includes a representative mix of ages, ethnicities, household incomes and homeowners/renters. Dana French, who has more than 20 years of home furnishings and consumer research experience, led the Consumer Insights Now project, which is sponsored by ChargeAfter and Genesis Credit.