Consumer Insights Now research surveys shoppers about how higher prices may affect buying decisions

HIGH POINT — One of the factors affecting furniture purchases in recent months is inflation, something that has been a blessing and a curse to the industry.

A blessing because it has raised prices to more respectable levels, thus covering cost pressures in the marketplace and also helping some retailers achieve higher profit margins. But industry observers have noted these increases have reached a breaking point. In response, some suppliers have announced price decreases that reflect drops in container and materials costs.

Inflation is among the issues we’ve addressed in our inaugural Consumer Insights Now research, an exhaustive survey of some 2,000 consumers around the country compiled by furniture research expert Dana French. The national report will be published this coming Monday to be followed by five regional reports.

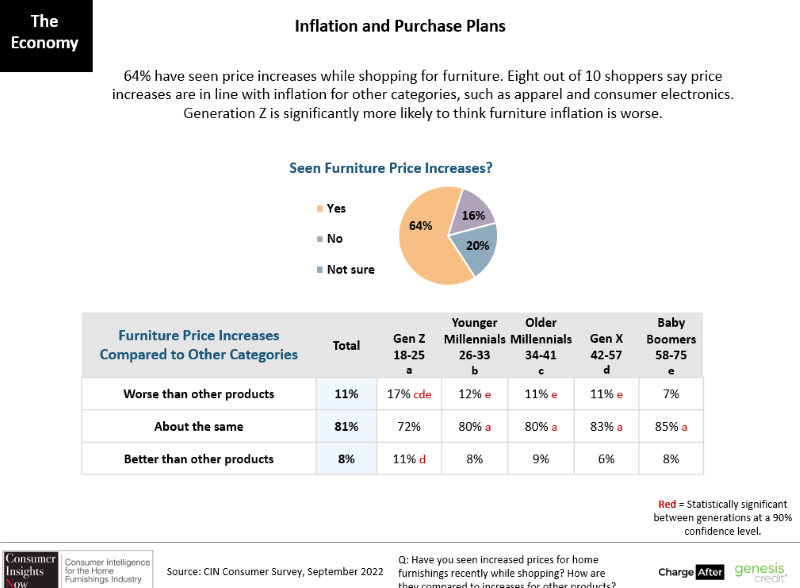

In the survey, which took place in mid-July, French asked consumers to what degree they’ve seen price increases. About 11% of the total surveyed said that inflation was worse for furniture than other product categories, while 8% said it was not as bad.

Some 81% of those surveyed said it was about the same, which is perhaps not really good news, especially when you compare it to the skyrocketing price of things like fuel and food at the time of the survey.

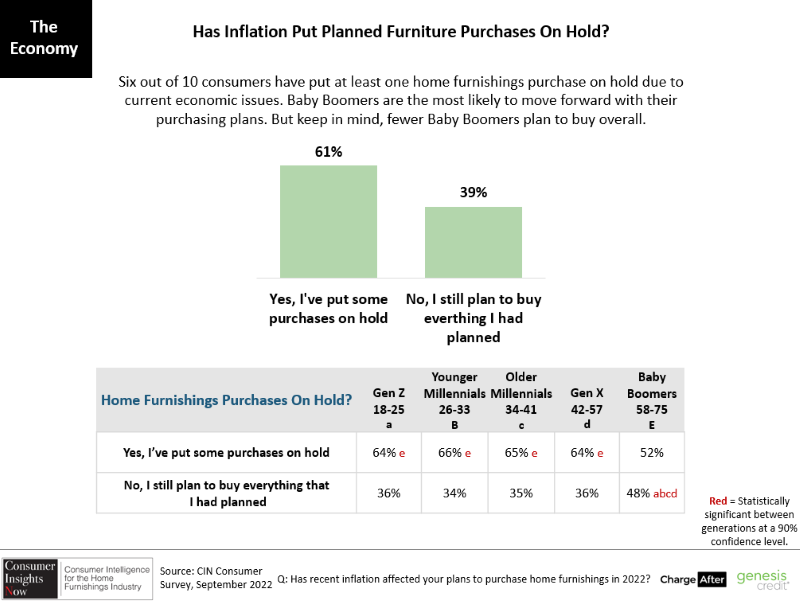

Perhaps not so ironically, six out of 10 consumers surveyed said they plan to put some of their purchases on hold until next year due to inflation and other economic uncertainties. The percentages of wary consumers was roughly the same among various age groups — from 64% to 66% for those ages 18 to 57, while the numbers dropped to 52% for baby boomers ages 58-75.

Categories those consumers plan to put on hold are quite similar to those others indicated they plan to buy during the second half. Topping the on-hold list: upholstery and other living room furniture and mattresses for the master bedroom, followed by outdoor furniture, area rugs and master bedroom furniture. Home entertainment, dining room, kitchen and office furniture followed, with 10-11% of consumers saying they planned to put off these categories.

The good news is that some 44% of those surveyed said they plan to purchase these and other items further down the list sometime in 2023, with another 17% putting the purchase off until 2024. Another 5% said they planned to put the purchases off until 2025 and 34% said they weren’t sure, which leaves plenty up to interpretation.

For those that plan to purchase furniture sooner, pricing may fall short of expectations, particularly in the wood category. Consider for example that 40% of those surveyed planned to pay between $250 and $750 in the dining category. That might get you an extremely promotional table and four-chair set.

But even pre-pandemic a sweet spot for casual dining was about $999 for a table and four chairs. In the past year, that’s probably risen by 50% or more based on inflationary factors ranging from high container costs to supply chain disruptions that have raised the price of certain wood species.

In the home office category, 37% expected to pay $100 to $249. In this market that probably won’t even get you a decent writing desk, much less a double ped junior executive desk, many of which also retail at $999 and higher. And other items in home office are potentially even much higher. For example, a retailer we visited over the Labor Day weekend had a credenza and deck unit priced at $3,999.

In the master bedroom category, a combined 36% of consumers surveyed expected to pay between $250 and $750. Certainly, some of those price points may hold true for RTA bedroom made with paper laminates. But a decent veneered set will likely cost you $2,999 or more for a bed, dresser, mirror and nightstand, compared to maybe $1,499 to $1,999 pre-pandemic.

None of this is to say that prices aren’t coming down as this is being written. A number of companies we’ve spoken with have issued letters to retailers announcing they are dropping prices due to decreases in container and overall freight costs, and an overall stabilization of some materials costs.

Expectations for many sofa prices are perhaps more realistic with 23% of those surveyed expecting to pay between $1,000 and $1,999, which sounds reasonably particularly in fabric. Another 33% of those surveyed expected to pay $499 to $999, although those would likely be considered to be promotional to lower middle price points.

That said, there are still categories most notably on the wood side — that might cause sticker shock for some. And even if prices come down, they might not be coming down enough to meet expectations of consumers that haven’t been in the market for a couple of years or more as cited in the research.

We can all only collectively hope that some of these high prices don’t cause consumers in the market for furniture to delay much longer than indicated in some of the research. While inflation has brought some prices closer in line with where they need to be, it likely does need to be reined in some to help fuel demand not only for the rest of the year, but also the year ahead — and beyond.

The research will debut Sept. 12 with the full national survey of nearly 2,000 consumers. It will be followed by five successive regional reports.

All respondents are either the primary or joint purchase decision maker and the sample includes a mix of females and males, ages 18 to 74 and includes a representative mix of ages, ethnicities, household incomes and homeowners/renters. Dana French, who has more than 20 years of home furnishings and consumer research experience, led the Consumer Insights Now project, which is sponsored by ChargeAfter and Genesis Credit.