Company remains profitable with net income of $15 million

DANBURY, Conn. — Ethan Allen reported a 6% decline in consolidated net sales and a 12.9% decline in adjusted net income for its fiscal 2025 second quarter ended Dec. 31.

Consolidated net sales totaled $157.3 million, down 6% from $167.3 million the same period a year earlier. Adjusted net income totaled $15 million, or 59 cents per share, down 12.9% from $17.23 million, or 68 cents per share, for the same period the prior year.

It reported retail net sales of $134.3 million, down 3.5% from $139.2 million the same period a year earlier and reported wholesale net sales of $86.8 million, down 4.2% from $90.6 million the prior year.

Written retail sales increased 15.8% during the quarter and wholesale net sales rose 14.3%, the company said. Its consolidated gross margin was 60.3% compared with 60.2% a year earlier and its operating margin totaled 11.5% compared with 12.8% the prior year.

For the first half, the company reported net sales of $311.6 million, down 5.9% from $331.2 million the same period a year earlier. It also reported adjusted net income of $29.7 million, or $1.17 per share, down 10.2% from $33.3 million, or $1.30 per share, for the first half of the prior year.

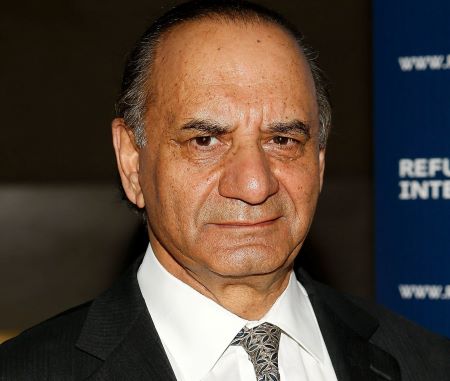

“We are pleased with our performance that saw incremental consumer interest return back to the home amidst a challenging political and economic environment,” said Farooq Kathwari, chairman, president and chief executive officer. “We are positioned well as a vertically integrated enterprise with 172 retail design centers in North America and more internationally. Our ability to manufacture approximately 75% of our furniture in our own North American facilities is a major advantage. We continue to strengthen various areas of our enterprise, including our talent, product offerings, marketing, retail network, manufacturing, logistics, technology and social responsibility.”

Other highlights of the Q2 report are as follows:

+ The company said it generated $11.6 million in cash from operating activities, compared to $13.6 million in the prior year.

+ It reported ending the quarter with $184.2 million in cash and investments, with no debt outstanding.

+ It had inventory levels of $142 million as of Dec. 31, 2024, up $1.1 million from a year earlier.

+ It ended the quarter with 3,318 workers, down 6.9% from a year earlier and down 27% from Dec. 31, 2019.

+ Cash from operating activities totaled $26.7 million during fiscal 2025, down from $30.3 million in the prior year because of lower net income and changes in working capital.