Lee Child, the prolific writer of the Jack Reacher series of page-turners, said that the way to write a thriller is “to ask a question at the beginning and answer it at the end.” This column’s thriller starts with this simple question: Why would Franchise Group dump W.S. Badcock just two years after acquiring it?

As reported by Home News Now just a week before Christmas, Woodlands, Texas-based Conn’s acquired Badcock from Franchise Group in an all-stock deal a mere 25 months after Franchise Group bought the chain for $580 million.

What did Franchise Group get in the deal? Exactly 1 million newly issued nonvoting “senior preferred shares” of Conn’s stock convertible to nonvoting common stock. How much is this in dollar terms? This is where it gets confusing.

We do know that the 1 million share total will represent 49.99% of Conn’s outstanding common stock. We also know that on Jan. 5, Conn’s share price was $4.71. What we don’t know is how many common shares those 1 million “senior preferred shares” will net. But, at least one publication, MarketLine, put the value of the transaction at $3.04 million.

Even a top-of-the-range valuation of, say, $25 per preferred share would reach only $25 million, which would make the deal a bit like firing Jimbo Fisher or buying out Bobby Bonilla.

Treating the Badcock boondoggle as a kind of metaphorical crime scene, I approached the question with the forensic tools of news and business databases, archival research and a careful reading of financial statements. My goals included identifying motive, means and opportunity, and I reminded myself that guessing is how reason proceeds in the absence of facts. (Just to repeat, CSI here is just a metaphor; I’m in no way connoting the committing of a crime.)

Means and opportunity are easy. First the means: an all-stock deal. One million shares in a company that had just reported a more than $51 million net loss for the fiscal third quarter ended Oct. 31, or more than double its third quarter shortfall a year prior and the third consecutive quarterly loss of the year.

Coming on revenues of $280 million, the third-quarter net loss followed dips for the first and second quarters, respectively, of $35 million and $34 million, according to filings.

One bright spot: Third-quarter sales online rose 51% compared with the same quarter in 2022.

Next, opportunity.

In Franchise Group, another company that had just posted a roughly $50 million quarterly loss, Conn’s found a willing seller. Perhaps a more-than-willing seller. Conn’s gave up a relatively small piece of the rock to get possession of Badcock and grow its store count to 550 in 15 states. In exchange, Franchise Group exits the business of operating Badcock and selling its receivables. More on receivables in a moment – they are potentially the proverbial smoking gun.

The mystery

With 1 million Conn’s shares in its portfolio, Franchise Group would become the second-largest stakeholder in the company. Dimensional Fund Advisors is first, with nearly 1.2 million shares, according to CNN, while BlackRock Fund Advisors would move to third with just over 800,000 shares. (BlackRock Advisors owns another 450,000 shares, while BlackRock Financial Management owns 245,000.)

It’s no wonder that law firms are looking into the Conn’s-Badcock deal and offering litigation services to shareholders.

New York law firm Wohl & Fruchter, for example, is “investigating the merger” and offering to discuss with Conn’s shareholders their “concerns about this deal,” according to a press release.

“We are investigating whether [Conn’s] board of directors acted in the best interests of shareholders in approving this transaction,” said Joshua Fruchter, a partner at the firm. “This includes whether all material information regarding the transaction has been and will be fully disclosed to Conn shareholders.”

New Orleans-based Kahn Swick & Foti is another law firm looking into the deal and offering shareholders counsel.

“Investigating” here means little more than what this column is seeking to do, and issuing a press release about it is a convenient way to announce that your law firm does this sort of litigation and would be happy to pursue action on a shareholder’s behalf . . . for a fee. News outlets run press releases for free; advertising costs money.

That said, there are more than a few red flags waving in the Wall Street winds on this particular transaction and its timing. These flags and the deal’s timing could point us to the motive.

Staring at the pinboard

Let’s stroll over to the evidence board to look at a few possible connections. I’ll bring the red yarn and push pins.

First, let’s note that Conn’s filed its third-quarter earnings report late because the company’s CFO abruptly resigned about the time that the filing was due. Conn’s chief accounting officer, Timothy Santo, had to step in to sort things out after CFO George Bchara jumped ship.

Let’s push the timeline back a bit further. Bchara’s departure followed by one year the also-sudden resignation of Conn’s CEO Chandra Holt in October 2022 after just 14 months on the job. Holt’s departure sent Conn’s stock price reeling to a two-year low. (Strangely, Holt’s LinkedIn profile more than a year later still lists her as president and CEO.)

If one red string connects Conn’s to Franchise Group, another connects Franchise Group to Prophecy Asset Management.

Bloomberg reported in November that John Hughes, co-founder of Prophecy, admitted to defrauding clients of nearly $300 million in a “sophisticated” investment scheme. In pleading guilty to commit securities fraud, Hughes named two co-conspirators. We now need a dotted line between Hughes and Brian Kahn, CEO of Franchise Group, who may or may not be one of the other co-conspirators.

Bloomberg reported that “a person familiar with the matter,” who was not identified, had named Kahn as one of the two co-conspirators that Hughes implicated. Kahn denies this, saying via a statement that “at no time during my former business relationship with Prophecy did I know that Prophecy or its principals were allegedly defrauding their investors, nor did I conspire in any fraud.”

Kahn said he stopped doing business with Prophecy “several years ago” and that “in no way, shape or form has this previous relationship impacted Franchise Group.”

“Several years ago” doesn’t help much here, however, because Hughes shut Prophecy down in March 2020. The charges from the Securities and Exchange Commission, which called the fraud “brazen and sophisticated,” therefore, also are from “several years ago.”

Prophecy lost $294 million of investors’ money, then “concealed the losses by recording bogus transactions and forging documents,” according to an SEC statement. Prophecy’s investors included pension plans, family trusts, institutional investors, and individuals foreign and domestic.

The back story

The plot thickens when we consider Kahn’s and Franchise Group’s close ties to B. Riley Financial, the firm coincidentally handling the closing sales of Z Gallerie locations nationally in the Direct Buy bankruptcy.

For the pinboard, it’s here the red yarn gets braided.

First, B. Riley’s co-CEO, Bryant Riley, served on Franchise Group’s board from its inception to March 2020, the same month that Prophecy closed up shop. B. Riley assisted Franchise Group in forming in June 2019, a $138 million deal that combined Liberty Tax and Buddy’s Home Furnishings. (Kahn was a director of Buddy’s at the time.)

Just five months ago, B. Riley helped the Franchise Group senior management team led by Kahn to buy out the company in a deal worth $2.6 billion, a transaction that saw B. Riley invest about $281 million, according to a report in Mergers & Acquisitions Online.

Prior to the buyout, in 2018, B. Riley and Kahn failed in their bid to acquire RTO powerhouse Rent-a-Center. Kahn was then heading up Vintage Capital Management.

Fast-forward to November 2021, B. Riley agreed to buy $400 million of Badcock’s receivables and to take on even more in receivables in 2022 to make Franchise Group’s $580 million acquisition of Badcock possible, according to Mergers & Acquisitions Online.

Citing Badcock’s “deteriorating outlook,” however, B. Riley changed directions in 2022, saying it had no more appetite for the furniture chain’s receivables. This was understandable considering that B. Riley had posted losses in four of its previous eight quarters and would report a 2022 deficit of $168 million. For what is essentially a big bank, money was tight.

Just before the Conn’s announcement in December, B. Riley reported a third-quarter loss of $76 million on revenues of $462 million, sending its share price further downward. B. Riley’s share value is down more than 50% since mid-July, according to Mergers & Acquisitions Online in mid-December. The Motley Fool speculated that the Prophecy fraud case was causing concern among investors.

Meanwhile, over at Franchise Group, just two months ago S&P Global Ratings downgraded the company’s credit rating, dropping it further down in junk status to “B-” from “B” and assigning it a negative outlook because of weak performance. S&P also said it was monitoring legal developments relating to Kahn, probably a reference to the Prophecy fraud case. “Investors need to tread carefully here,” the investment guidance company cautioned.

The big reveal

To return to motive and perhaps an answer to the question, consider that a nearly $5 billion company recently taken private by a senior management team eager to improve its outlook took as its first step the unloading of a drain on profitability. Badcock had to go, especially now that Franchise Group has completed the sale-leaseback of all 35 Badcock retail locations and all three distribution centers. (B. Riley Real Estate advised on the transactions.) The store sales yielded $94 million, according to Franchise Group, and they included corporate- and dealer-owned locations. The DC sale generated approximately $150 million.

Still well below the $580 million expenditure, but enough to pay off the $175 million in financing to acquire Badcock.

Back to the timing: Coincident with the management team buyout in August, Franchise Group posted a second-quarter net loss of $51 million on revenues of just over $1 billion, with Badcock representing $31 million of that loss on revenues of $172 million. For the first six months of last year, Franchise Group lost $159 million on revenues of $2.2 billion.

Consider also that B. Riley, a turn-around and bankruptcy specialist, made it clear that it would no longer supply the cash for the Badcock business model by taking on its receivables.

Finally, consider that the Badcock business model and customer base are similar to those of Conn’s, which saw an opportunity to acquire a competitor by simply issuing stock. Conn’s claims that on top of this, merging systems could save as much as $50 million in the first 18 months in newfound efficiencies.

“Conn’s and Badcock share complementary business models, histories and customers, and the expected revenue and cost synergies are extremely powerful,” said Mitchell Stiles, president and COO of Badcock, which will operate as a subsidiary of Conn’s.

I’m not saying the pinboard is complete; there are plenty of missing pieces in this complex financial jigsaw puzzle. But maybe if we stare at the cork board long enough . . .

I wish Brian had analyzed some of the financial shenanigans in our industry during the 80’s LBO craze. CNBC, Bloomberg, and Fox Business News should be so lucky to have this caliber of reporting! Kudos to Brian and HNN!

Good to hear from you, Jeff. I did think of Masco and Ladd writing the story, for sure. I might have titled the story “Taming Lyons”. Cheers to you!

Thank you Brian for the review. As a former shareholder of W. S. Badcock my concern has always been about the health of our dealer network and the corporate employees who fire the engines everyday to help the homeowners or renters in the southeast, “make their house/place a home”. I believe the merger of Conn’s and Badcock will be a win/win looking into the future of the two companies but, could take a bit longer on the timeline as proposed.

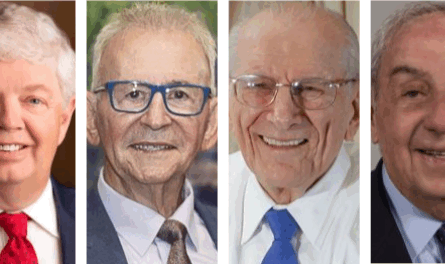

Norm Miller is not a dummy, as he takes over the reins of Conn’s again and nor is Mitchell Stiles who runs Badcock. Both of these men understand that to make your house a home, you need furnishings . And that is the sweet spot, to offer your furniture, appliances and electronics, etc. at affordable prices with reasonable terms on those transactions that consumers can afford to pay.

Could Mr. Kahn’s move to merge Badcock with Conn’s can pay him and his senior team dividends in the future? My guess is that it will for the betterment of the industry.

I’m eager for season two of your CSI review.

Thank you for your reactions, Mr. Badcock. We met at a leadership conference a long, long time ago, so it was a great delight to get a pingback with your name on it. And I appreciate your confidence in the potential synergies of the acquisition, in particular for Badcock dealers, who have had a roller coaster ride these last few years. They deserve some stability, predictability, and good stewardship of the brand. Now, back to the pinboard . . .

Sir. I may have some info to point you in a direction. Look into Lee Wright. He was a previous CFO / COO of Conn’s then went to CCO of FRG, then CEO of VitaminShoppe which is owned by FRG. Very Strange. I work for Conn’s actually and of course they won’t tell you we just had layoffs… Doesn’t sound like a company financially strong enough to buy another.

Yep. I was laid off as well. My prediction is that Conns will go bankrupt in the next year.

Loved your article. I was laid off from Badcock recently for “cost saving” factors. I just walked in and was told my position was no longer needed. I truly believe there will be many more “cost saving” examples in the near future.