Survey shows what categories people plan to buy most and where they plan to make those purchases

HIGH POINT — With the publication of our Look Back at buying trends in the second half of 2022 this past week, we are pleased to offer the next most logical installment of our Consumer Insights Now research: a look ahead at planned consumer purchases in the first half of 2023.

Compiled by our team’s industry research expert Dana French, this was based on a Jan. 21-25 survey of nearly 1,900 consumers ages 18-75. It includes men and women along with a representative mix of generations, ethnicities, household incomes and homeowners and renters.

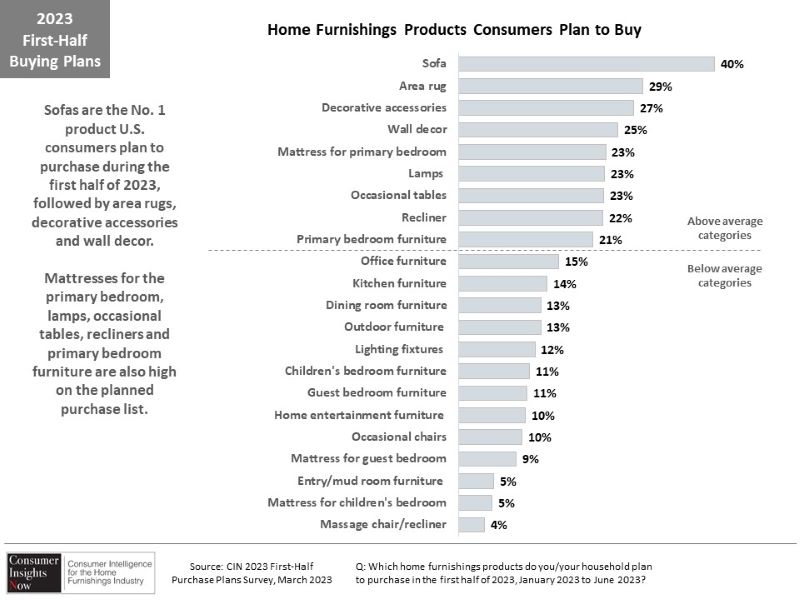

Not surprisingly, sofas were the No. 1 item that 40% of consumers surveyed planned to purchase in the first half. It was followed by area rugs (29%), decorative accessories and wall décor (27% and 25% respectively), mattresses, lamps and occasional tables (23%) and recliners and primary bedroom furniture (at 22% and 21%) respectively.

The numbers fell dramatically from there with only 15% surveyed saying they planned to buy office furniture, 14% kitchen furniture, 13% dining room and outdoor furniture, 12% lighting figures, 11% children’s and guest bedroom furniture and 10% for occasional chairs and home entertainment furniture.

Ranking at below 10% were mattresses for guest bedrooms, entryway or mudroom furniture, mattresses for children’s bedrooms and massage chairs and recliners.

The age group planning on making the most purchases? You guessed it — millennials, who fall in the 18-42 age group. They plan on making seven of 10 home furnishings purchases in the first half. This was followed by Gen Xers ages 43-58 at 18% and baby boomers ages 59-75 at 13%.

Nearly 60% of respondents said they shop for furniture when they have a need for something specific, compared to 25% who shop in response to a sales event. The lowest was 3% shop when a new store opens.

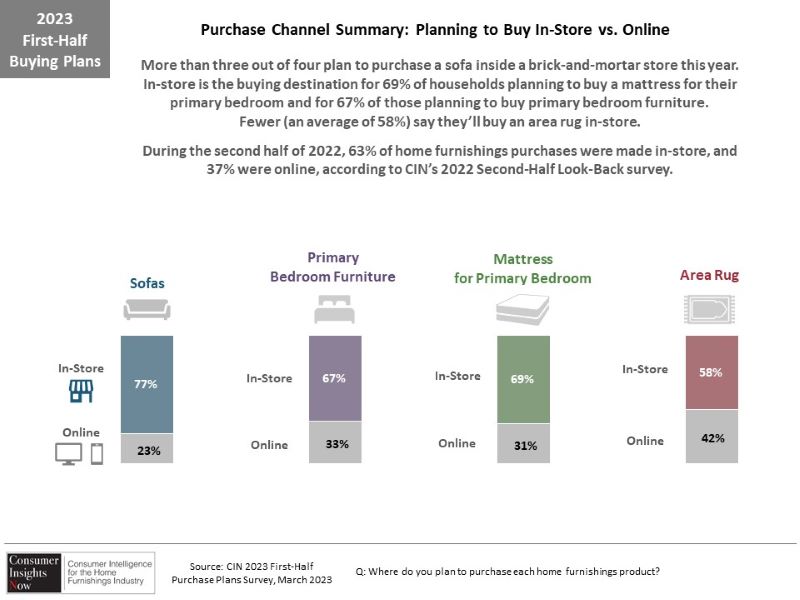

Nonetheless, brick-and-mortar stores remain a top choice when consumers finally do decide to shop. Some 77% of those planning to buy a sofa will shop in a store, compared to 23% who plan to shop online. For primary bedroom furniture this drops to 67%, while 69% of those surveyed plan to shop for mattresses in a store versus 31% who plan to shop online. For area rugs, this fell to 58% favoring an in-store experience versus 42% planning to shop online.

Some 69% of those surveyed also said they shopped in-store because of the ability to sit on, feel and lie down on the product, compared to 37% who said they chose this channel because of the delivery experience.

Nearly 30% said they chose to shop in-store because they are used to doing so and find that stores have better sales and deals. Another 25% said they chose to shop in-store because of the store’s ability to haul away old product, compared to 20% who said that stores had a better selection of fabrics, styles and colors, followed by 19% who said that they received personalized service during the sale and 18% who said that stores offered in-home assembly.

The top four reasons that consumers said they wouldn’t shop in a physical store included pricing, bad store reputation, distance from their home and an issue with the store’s actual location such as being in a high traffic area and a lack of parking or safety issues.

The survey also lends insights into what will make consumers come back to stores to purchase and what things they believe could be improved in the store experience. Here are several key takeaways of things that they want when shopping a physical store location:

+ A greater selection

+ A wider selection of top-quality brands with plenty of product to curl up on and test out

+ Accent pieces and small furniture items being available for purchase and take home the same day

+ Having a room set up so you can picture what it will look like

+ Being able to sit on the furniture before buying it

+ Ability to see the same piece in different colors

+ Faster delivery times

And the reasons consumers shop for/purchase furniture online?

+ 57% said free shipping

+ 56% said for the convenience factor

+ 45% said because of better sales and deals online

+ 33% said a wide selection of styles, fabrics and colors

+ 20% said it is easier to customize product online

+ 17% said they can use online technology to see and place the furniture in their home

Thus these results give brick-and-mortar retailers an idea of where they may have strengths and where they may need to improve. Respondents also said there are ways that online retailers can improve their own service levels ranging from the ability to talk to a salesperson online along with having a chat box to have questions answered — to better after-sales service and better customer support.

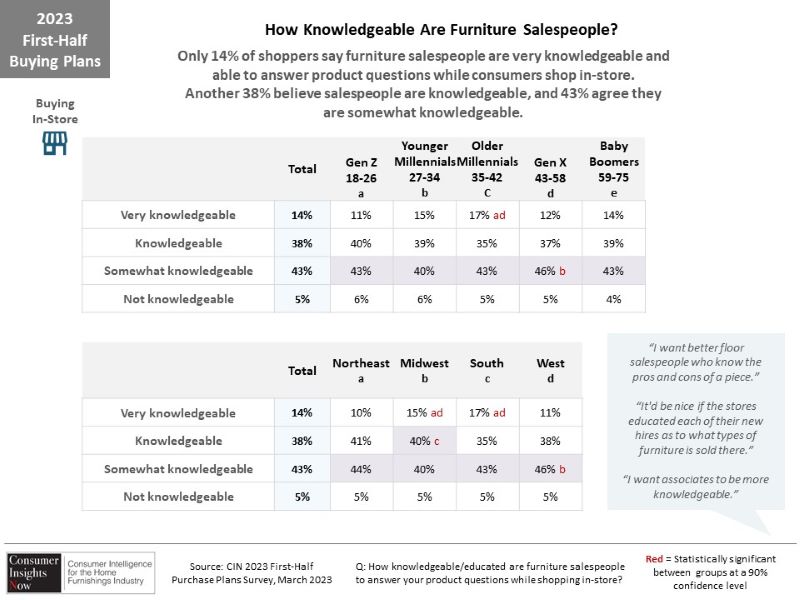

Thus, customer support is as critical a part of the buying experience as dealing with a knowledgeable salesperson. The good news for brick-and-mortar stores is that the majority of shoppers in all age groups view furniture salespeople as somewhere between knowledgeable and very knowledgeable, which is a contributing factor to them planning to buy big-ticket items at the store.

We hope that the results of this survey prove useful to you in the months ahead, identifying both areas of strength and areas where your business could improve. And as we head into the market cycle, we also hope it provides some insights into the types of products that consumers are looking for in a way that helps guide some of your own buying decisions.

We also are grateful that consumers participated by sharing their thoughts with us and you, our readers. Such insights can only help the industry at large as we move ahead into what could be a period of prolonged uncertainty. Being armed with knowledge only will better prepare us all to deal with those challenges.