NEW YORK — A survey by point-of-sale financing platform ChargeAfter shows that only 12% of retailers achieve finance approval rates of 80% or higher and that nearly a third of retailers report that consumer financing rates are less than 60%, meaning at least 40% of customers leave with a poor experience, thus causing retailers to risk losing significant revenues.

Conducted in December by independent survey company Global Surveyz, this and other information gathered was based on interviews with 100 executive retail decision makers in the U.S. with annual revenues of at least $250 million.

According to ChargeAfter, furniture and housewares made up 19% of the survey respondents, coming in just below the top category of department stores. Home improvement, sports and leisure and apparel stores followed at 18%, 16% and 15% respectively, with other categories such as outdoor, footwear, jewelry, electronics and other categories falling below those key segments.

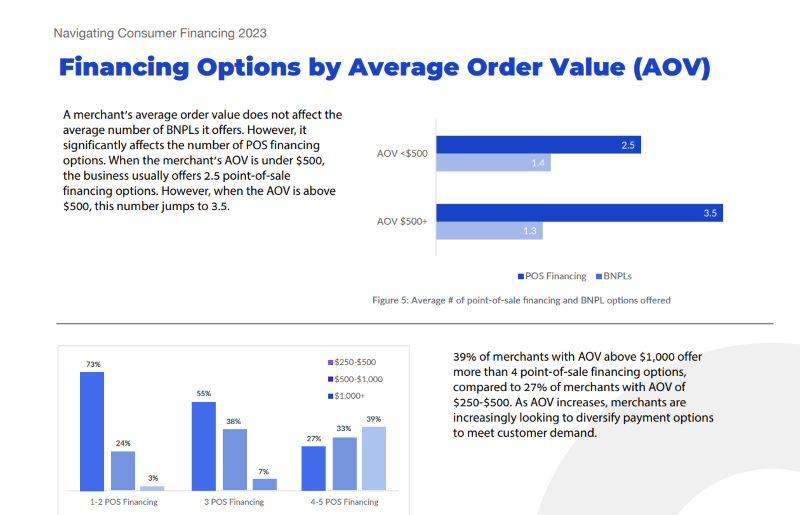

The company noted that consumer demand for financing is on the rise, particularly for lower-priced items. Some 75% of those retailers surveyed, for example, said they expect consumer demand to grow this year. Rising inflation, the company added, is increasing demand for more financing options, including for lower-ticket items of under $500.

The survey noted that such consumer financing requests largely affect near-prime and subprime customers, which the company said illustrates how critical it is for merchants to expand their financing options.

Other key findings of the survey:

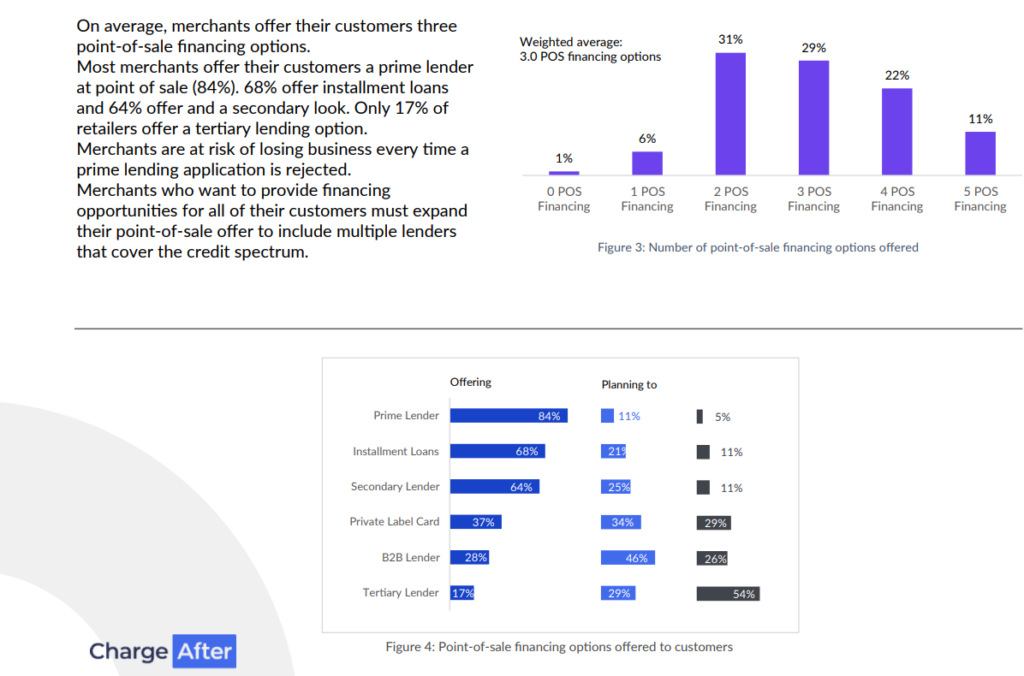

+ To better serve customers covering the complete credit spectrum, retailers plan to expand their portfolio of lenders this year with some 43% saying they want to add a B2B lender, 29% saying they want to add a tertiary lender and 25% saying they plan to add a secondary lender to their list of financing options. “This drive to broaden options for consumers will directly improve approval rates and direct revenues for merchants who are not meeting their customers’ financing needs. Additionally, a network of lenders enables merchants to keep discounted rates and offer consumers competitive interest rates.”

+ Providing omnichannel financing options is key for most, although smaller merchants lag behind. The survey noted that consumers may prefer to apply for financing online and only go to the store once they have been preapproved. Some 54% of merchants surveyed offer a hybrid point-of-sale financing experience and those with annual revenues of more than $500 million are more likely to be omnichannel (63%) compared with those with annual revenues less than $500 million (41%). “Retailers that do not provide omnichannel consumer financing may lose out to the competition.”

+ End-to-end management of the financial cycle is crucial for financing platforms. The survey noted that 66% of retailers are prioritizing implementing a consumer financing platform in 2023. A top priority is that it should manage the whole financing cycle, including reconciliations, chargebacks and dispute resolution. This is followed closely by offering an omnichannel experience and connectivity to multiple lenders. “Merchants require point-of-sale financing platforms that can manage the burden of multiple, complex requirements.”

+ Consumer finance is becoming an integral part of the customer experience and is thus linked to customer experience, revenues and business growth. Some 27% say that it belongs to customer experience or omnichannel departments, and 16% have created a unique function. “With technology investments and expansion a priority for 2023, merchants must consider whether their financing offer is competitive enough to support their business goals.”

The survey also noted that on average 1.3 retailers offer their customers buy now, pay later options; 64% offer one such option and 35% offer two such options. One percent of those surveyed offer no buy now, pay later option. The company said that many may only offer one such option because of the perceived negative impact offering more than one option has on the customer experience, for example, complicating the application process and also contributing to back-end complexity for retailers.

Key point of sale options currently offered by retailers include: a prime lender at the point of sale (84%), installment loans (68%), secondary lending (64%) and tertiary lending (17%). But the report noted that merchants putting all of their eggs in the prime lending option could risk losing business each time a prime lending application is rejected. “Merchants who want to provide financing opportunities for all of their customers must expand their point-of-sale offer to include multiple lenders that cover the credit spectrum,” the report said.

The survey went on to note that high approval rates not only help merchants grow their business but also improve customer satisfaction and increase the likelihood of repeat business. It also noted that merchants that don’t improve their practices to achieve higher approval rates are at risk of losing out to the competition.

“Our survey indicates that most merchants are missing out on a significant opportunity to increase sales and improve customer satisfaction,” said Einat Etzioni, executive vice president of marketing at ChargeAfter. “Merchants who are able to provide their customers with access to a choice of financing products from multiple lenders that cover the entire credit spectrum, are more likely to meet consumer demand for point-of-sale financing, increase sales, and build long-term customer relationships. A platform also offers the easiest way for retailers to handle the complex financing cycle, including disputes, refunds and reconciliations.”

For the full survey results click here.