JACKSON, Miss. — Back in 2019, Miskelly Furniture was of two minds when it came to consumer financing.

On one hand, the seven-store Mississippi retailer knew just how important a tool no-interest and other financing plans could be; the average ticket on a financed purchase was nearly double what customers spent when they paid by cash, check or credit card. On the other hand, it felt like the cost of offering financing — such as zero-interest programs for 36, 48 or even 60 months — was getting out of line.

So Miskelly employed various tactics to limit their use and reduce that pressure on profit margins. It required things such as fairly large down payments and big minimum purchases just to qualify, especially for the most expensive of the plans.

“It was really a split mindset,” said Alan Vonder Haar, Miskelly’s director of strategic development and growth. “We know that financing is important. We felt it was going to be even more important going into the future and yet we were coming up with ways to minimize the use of it.”

But by the end of that year, just before the Covid pandemic, Miskelly had come up with a strategy that deployed consumer financing in a new, better way, one that gave customers everything they wanted without cutting too deeply into the retailer’s bottom line. It involved, in part, doing away with the popular 60-month, no-interest plans that retailers typically trot out during important promotional periods and replacing it with a 60-month, low-interest plan available everyday.

Home News Now has reported on similar financing offered today by Florida’s City Furniture and La Mirada, Calif.-based Living Spaces, but for the first time, perhaps, a retailer is spelling out for everyone their success with the switch, how it lowered its cost of offering consumer financing, how it’s still satisfying the needs of customers and how it managed to get everyone on board. (It wasn’t so much the consumer fighting the change.) Vonder Haar did so this month at a special “Financing Springboard” event in Dallas co-sponsored by Wells Fargo Retail Services and Furniture Marketing Group that was attended by about 40 people from FMG member retailers.

He shared the gist of his presentation with HNN, both the predicament and the success that followed. But first a little more on the problem:

Offering 60-month, 0% APR financing is an expensive proposition for any furniture retailer. It could cost a company in the neighborhood of 15% of the purchase price. In other words, when a customer finances a $1,000 purchase, the lender gives a retailer such as Miskelly $850 and keeps the rest. Sister plans, such as 48- or 36-months no-interest, get a little cheaper, but still cost in the double-digit percentages. That eats into a retailer’s gross profit margins pretty quickly.

So while Miskelly used the plans to satisfy the consumer’s financing needs, it also employed ways to minimize the impact and, at times, discourage their use, such as the previously mentioned minimum purchase requirements. The longer the terms, the larger the minimum. It would also require large down payments, often 20%. And customers weighing a financed purchase had to think in terms of “either/or.” They could have the long-term, no-interest financing or they could have whatever other special discount or promotion Miskelly was running at the time. But they couldn’t have both.

In addition Miskelly, looking to protect the financial health of the business, also had to contend with well-intentioned salespeople, who were working directly with the customer. They wanted to make the sale, but they often wanted their employer to bend some rules to get it.

“We found back in 2019, a salesperson would come to a sales manager and basically say, ‘I’ve got this really good customer. They want to spend $4,000, but they don’t have $800 for the down payment,’’’ Vonder Haar recalled.

What would happen next, he said, is the manager would waive that down payment, or, in other situations, the manager would waive other requirements in order to get a customer into a longer-term plan, even when the purchase price didn’t qualify for it. These were clearly good deals for customers, but they skirted rules in place that were designed to protect Miskelly from giving away the store.

“The customer only looks at financing as a means by which to pay for their furniture,” Vonder Haar said. “So there was this conflict between what the customer wanted and what leadership wanted for the company.”

“We wanted to come up with a way to maximize financing because going into 2022 and through the next three years, due to such factors as inflation and no stimulus money, we feel financing is going to become more important than ever before.”

In late 2019, Miskelly Furniture became an early adopter of Wells Fargo’s 60-month, special financing program, under which the consumer pays 8.99% interest vs. the 0% plan many retailers were using (and still do) during important promotion periods. The monthly payments for the customer, Vonder Haar said, work out to about $20.89 for every $1,000 financed. The cost of offering this financing is somewhere in the neighborhood of 3% vs. around 15% for 60-months, no interest.

If you think the customer may have been up in arms about suddenly having to pay interest on a five-year financing plan, you’d be wrong. And that might have everything to do with how Miskelly executed the switch. Vonder Haar said the retailer “empowered the customer with choice,” while at the same time, it held salespeople accountable. They had to stick to the plan.

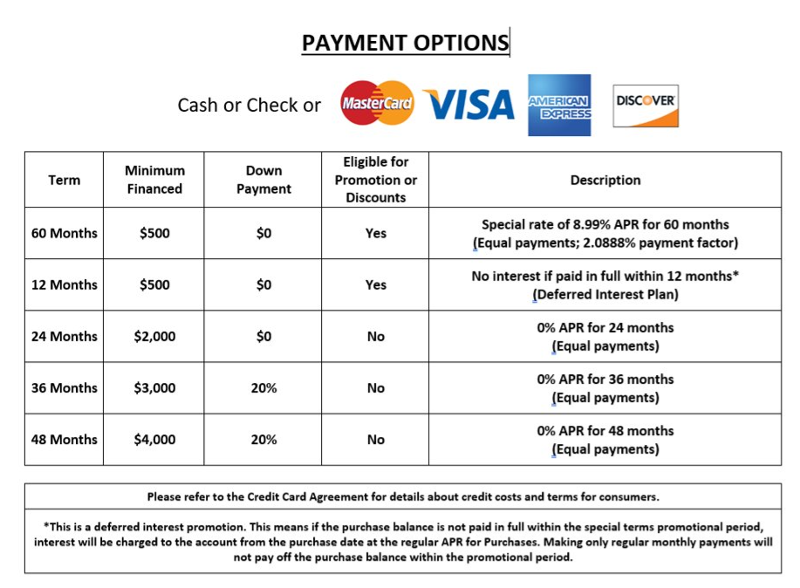

Under the Wells Fargo program, Miskelly came up with this card showing all its financing options available all the time.

And once it had empowered customers with these clear choices, Miskelly was able to find out what the customer really wanted, not what salespeople told it they wanted, Vonder Haar said:

89% of the time, they said they wanted no money down.

80% of the time, they wanted no interest.

75% wanted the “either/or” to become “and.” They wanted both the long-term financing and the special discount or other promotions.

And 45% wanted low monthly payments.

“When we made the switch, we decided to ‘create, not tolerate’ a financing plan, where if the customer truly wanted low monthly payments, the 60-months, special financing was now available to them,” Vonder Haar said. That was the big change. Most of the options remained the same as before, but the presentation was key. Everything the consumer said they wanted was there and spelled out clearly in one or another option presented.

At the same time, Miskelly was able to hold the line with salespeople. These were the financing plans available every day, no exceptions, so don’t go to a sales manager asking to have some condition waived.

“Today it’s so ingrained in our culture, nobody asks to violate this plan,” Vonder Haar said.

“What we did is we educated the customer on what the payment options they qualified for were, and then simply asked, ‘Which plan works best for you?’

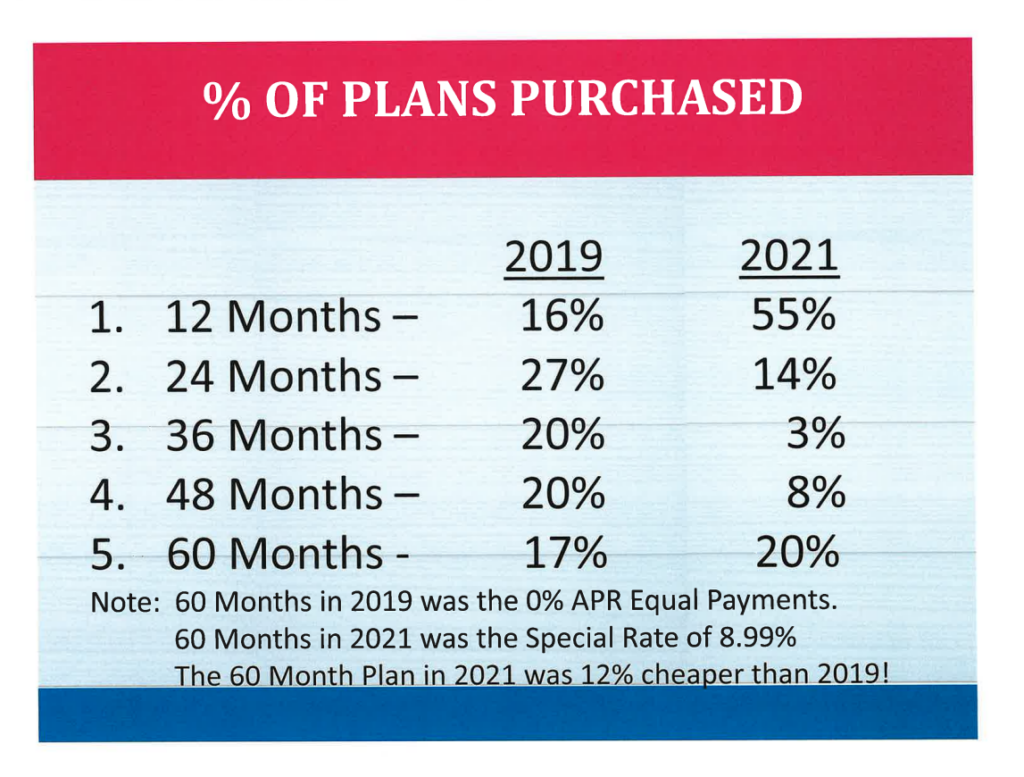

“Once we empowered the customer with choice, gave them the boundareis and let them choose, something miraculous happened.” Vonder Haar presented a slide similar to this at the Wells/FMG event to explain what he meant:

Back before Miskelly made this change, 84% of the finance plans it was offering cost the company 8.5% or more. Today, Vonder Haar said, 75% of its plans cost it 3% or less. And the 12-month option, the least expensive plan, went from representing 16% of all finance plans purchased to 55%. It’s the most popular, and the reason: It covers all of the core things consumers say they want — no down payment, no interest and eligibility for other discounts and offers.

And if they want a lot more time to pay, but still want to be eligible for other discounts and promotions, now they can go for a 60-months, special financing option with no money down, the second-most popular plan.

Another benefit to Miskelly’s strategy shift is that salespeople now know what the financing offer is every day because it never changes. “Back in 2019, we would come up with a variety of different marketing techniques because financing was treated as an offer,” Vonder Haar said. Today, while Miskelly’s advertising changes, the financing piece is a constant, a never changing way for the customer to pay for its merchandise.

“So we get to promote 60 months, no money down every day of the year, which has an impact,” he said.

Take a look at how financing is promoted in one of Miskelly’s commercials today:

Steve Jermier, senior vice president of relationship management for Wells Fargo Retail Services, told HNN low APR consumer financing is entering the marketplace “to a different level than maybe we saw five or 10 years ago. It started in home improvement, but we’re starting to see that navigate its way into more traditional retail finance space.”

For the plans to work and truly provide value, Wells Fargo believes the APR needs to be in the single digits, he added.

Back at Miskelly, the percentage of purchases financed has actually decreased in recent years, but Vonder Haar said he wouldn’t want to imply this has anything to do with the switch. Instead, less people have financed purchases because of access to stimulus money “and the good economy we’ve been blessed with in our industry,” he said.

But all that may be changing.

“Certainly when you’re in an inflationary environment, where it feels like each month the goods we’re all paying for seem to be costing more and more, there’s no question the need for financing goes up as the cost for goods goes up,” Jermier said.

“When financing is working the way it should, it enables and empowers customers to buy now and pay over time. That’s exactly what you need when the cost of the products you’re purchasing are increasing at the rate they are right now.”