Company size and profitability, along with risk factors and opportunities, are highlighted in its registration statement filed with the US Securities and Exchange Commission

MANCHESTER, Conn. — Documents filed as part of Bob’s Discount Furniture’s registration statement for an initial public stock offering provide a window into the company’s history, growth and its financials, not to mention its planned growth to more than 500 stores by 2035, up from just over 200 currently.

This and other information highlighting the company’s product selection, community service and corporate culture are documented on Form S-1, which it filed with the United States Securities and Exchange Commission Jan. 9.

According to its filing, the number of shares to be offered and the price range for the proposed offering have not yet been determined. It noted that the proposed offering “is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.”

It did note that it plans to list its common stock on the New York Stock Exchange under the ticker symbol “BOBS.”

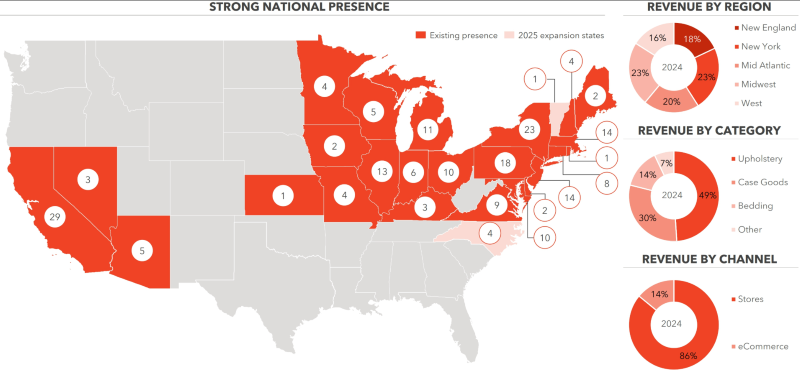

Established in Newington, Connecticut, in 1991, the company had 206 stores in 26 states, as of Sept. 28, 2025, up from 185 the same period a year earlier.

It reported net revenue of $1.72 billion, up from $1.43 billion a year earlier, and net income of $80.7 million, compared with $49.3 million the same nine-month period a year earlier. It reported adjusted comparable-store sales growth of 9.7% compared with a 6.9% decrease in the same metric for the first nine months of 2024.

According to its filing, it opened 17 new stores as of Sept. 28, 2025, compared with 15 a year earlier.

Brick-and-mortar stores accounted for about $1.5 billion, or 84.7% of net revenue for the first nine months of 2025, and e-commerce represented the balance at $262.4 million.

In 2024, New York and the mid-Atlantic represented its strongest markets at 23% of revenues respectively, followed by the Midwest at 20%; New England at 18%; and the West at 16%. The same year, upholstery was its strongest category, representing 49% of revenues, followed by case goods at 30%; bedding at 14%; and categories such as accents and accessories at 7%.

It identified 32% of its customer base between ages 42 and 59 and 30% from 30 to 44 and over age 60, respectively, while the number of shoppers under 30 was estimated at around 8%.

Gross profits in the first nine months of the year totaled $784.8 million, compared with $675.4 million the year before.

SG&A expenses totaled $662.9 million, or 38.5% of net revenues, compared with $674.4 million, or 47.3% of net revenues, a year earlier.

It reported no long-term debt outstanding as of Sept. 28, 2025.

The document also cites various risk factors in the business, including a significant reliance on furniture imports that are subject to tariffs.

“As of Oct. 24, 2025, our primary sourcing markets are Vietnam and the United States, representing approximately 63% and 27% of our product cost volume, respectively, with smaller sourcing markets in Thailand, Malaysia and Cambodia,” it stated in its filing. “As a result, our business depends on global trade, as well as trade and other factors that impact the specific countries where our suppliers’ production facilities are located.”

Overall, imports represented about 76% of its revenues for the first nine months of 2025.

“Our future success will depend in large part upon our ability to maintain our existing foreign supplier relationships and to develop new ones based on the requirements of our business and any changes in trade dynamics that might dictate changes in the locations for sourcing of products,” the company noted. “While we rely on long-term relationships with many of our suppliers, we have no long-term contracts with them and generally transact business with them on an order-by-order basis.”

It added that while it has pursued diversification in its sourcing and suppliers — including a reduction in sourcing from China and increased sourcing from emerging markets such as Malaysia and Thailand — its continued reliance on international suppliers “increases our risk that we will not have adequate and timely supplies of various products.”

It noted that its international supply chain also is subject to additional trade laws and regulations, public health crises, political instability and international conflicts, acts of terrorism and natural disasters and foreign currency fluctuations, to name several key issues potentially impacting global trade.

“The occurrence of any of the foregoing could materially increase the cost and reduce or delay the supply of our products, which could materially and adversely affect our business, financial condition, results of operations, liquidity and stock price,” the company said.

Other factors that impact its business it noted include competition from other national, regional and local retailers as well as e-commerce specialists.

In addition, it cited the health of the housing market and other factors such as the cost of materials, freight and other transportation costs as key areas that could impact its sales and bottom line.

However, it also identified its expertise in logistics as a key asset that helps drive customer satisfaction.

“Our efficient fulfillment process ensures most purchases have the ability to be delivered in as few as three days, rather than weeks, providing customers with a swift and reliable shopping journey,” the company said. “Speed and consistency of customer deliveries are enabled by our vertically integrated logistics network, anchored by five strategically located distribution centers and additional third-party regional depots. Disciplined inventory management ensures product availability matches customer demand and delivery preference, with approximately 86% of orders during the nine-month fiscal period ended Sept. 28, 2025, in-stock and ready to be delivered in as few as three days from the time of purchase. Our expeditious delivery timeline and overall convenience are key elements of our value proposition, and we believe greatly enhance our overall customer experience.”

It also identified the omnichannel nature of its business as another key attribute as it allows customers to experience and shop the brand in multiple ways.

“Over the past decade, we have made substantial investments in our omnichannel capabilities, enabling a seamless shopping experience across digital and physical platforms,” the company said. “Customers can shop online, in-store, over the phone and via our mobile app, with unified shopping cart functionality and consistent service quality.”

It went on to note that about 73% of its in-store customers reported engaging with the business via multiple channels in fiscal year 2025, “reflecting the strength of our integrated platform. To deliver this seamless customer experience, we leverage a highly integrated operating system that draws on the same inventory, pricing and logistics network whether our customers buy in-store or online. We believe our momentum, combined with our scale, enjoyable showroom and omnichannel journey, favorably positions us to grow profitably and continue to increase market share.”

It believes such opportunities to engage with the customer will guide the success of its business moving forward. These and other factors remain within its control as it seeks to continue on its growth trajectory in the year ahead and beyond with plans to grow its store network to more than 500 by 2035.

“We believe that our stores and customers’ store experience are key for generating and increasing revenue,” the company said. “We plan to grow our store base across both new and existing markets by opening new stores in areas with existing home furnishings demand.”

“Our growth strategy is fueled by significant and proven white-space potential, a disciplined market entry playbook and attractive unit economics, with new stores historically generating rapid payback periods and 80+% cash-on-cash returns,” the company added. “Our growth is guided by a disciplined playbook that informs what markets to enter and how to enter them. We focus our expansion on areas with strong furniture demand, particularly where there are existing furniture stores, to optimize capture of qualified customers in the market. Our brand and business model has resonated across market sizes and with a diverse range of customers. As our brand awareness grows in new and existing markets, our demand increases, which in turn allows us to invest even more heavily in customer awareness and thus continually drive stronger store performance.”