Industry jobs created in 2024 represent less than 1% of the total 244,940 created through reshoring and foreign direct investment

WASHINGTON — Reshoring continues to gain momentum as companies both in the U.S. and abroad invest in domestic manufacturing opportunities, according to the Reshoring Initiative’s 2024 report published earlier this week.

And despite the higher costs of manufacturing in the U.S., the report noted, shifting global dynamics such as tariffs, policy changes and supply chain risks are creating more opportunities and incentives to produce domestically, the report said.

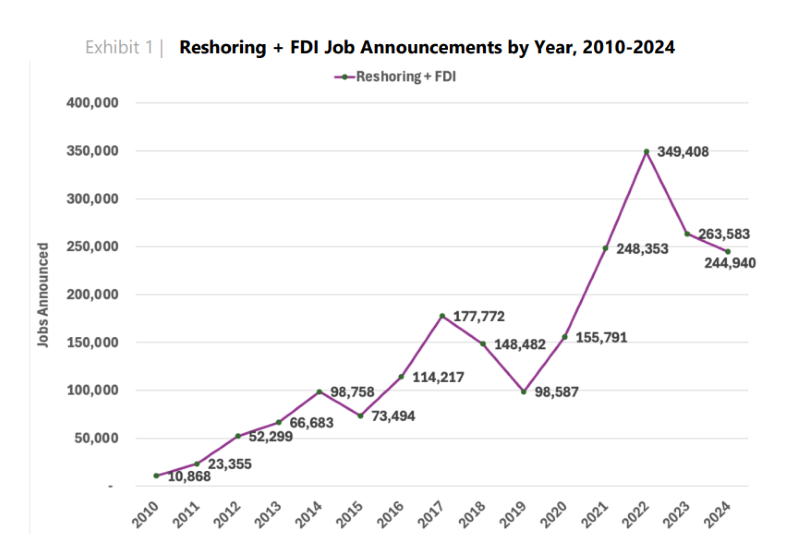

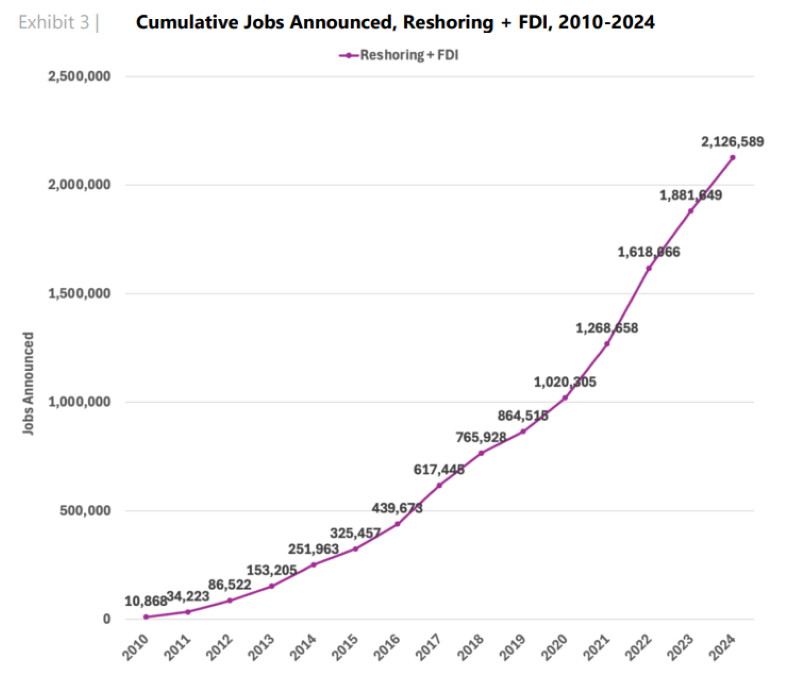

According to the report, some 244,940 jobs were created through reshoring and foreign direct investment in 2024, a trend the report said was “driven by companies seeking to shorten supply chains, reduce exposure in geopolitical risks and avoid costs associated with impending tariffs.” Some 64% of the jobs were created through reshoring and 36% were created through FDI.

But the numbers were down significantly from the past few years, including the 263,583 jobs created in 2023, 349,408 created in 2022 and 248,353 created in 2021.

It added that “President Trump’s objective of reindustrialization is synonymous with reshoring and FDI. All three processes are essentially import substitution — importing less and producing more. … Reversing job losses from offshoring signals not only economic recovery, but also revitalization of U.S. manufacturing strength, a stronger national defense industrial base and a strategic reduction in our dependence on foreign sources.”

In terms of jobs created last year, furniture manufacturing ranked towards the bottom half of the list, at No. 11. The report estimated some 1,970 jobs were created, or 1% of the total. This compares with 2,813 jobs created in the domestic furniture industry a year earlier, also 1% of the total for 2023.

Computer and electronic products ranked at No. 1, with 86,127 jobs created, representing 35% of the total. Also in the Top 5 were electrical equipment, appliances and components, with 75,900 jobs created, or 31% of the total; transportation equipment, with 21,970 jobs created, or 9% of the total; chemicals, with 21,349 jobs created, also at 9% of the total; and machinery, with 9,537 jobs created, or 4% of the total.

Coming in at less than 1% of the total jobs created were plastic and rubber products, with 1,146 jobs created; castings/foundries, a subset of metal products with 818 jobs created; and apparel and textiles, with 378 jobs created.

Note that higher-tech industries, including chemicals, which includes big-name pharmaceutical companies, transportation equipment and computer and electronic products and electrical equipment, far outpaced what could be perceived as lower-tech industries including apparel and textiles, plastic and rubber products and furniture.

The study noted that many of the estimated 1 million jobs that have come back to U.S. in the past four years alone are a result of government funding, or subsidies, combined with increasing levels of geopolitical risk in the global supply chain. This has resulted in more high-tech job creating than lower-tech jobs as many subsidized areas — based on their perceived importance to the economy and consumers in general — are technology-driven.

These companies, the report added, also tend to employ more workers, with 88% of job announcements last year in medium or high-tech products. The projection for 2025 rises to 90%, the report said, noting that this is significant because of the trade deficits in advanced technology products.

Thus, in its outlook for 2025, furniture job creation ranked even lower, dropping from No. 11 to No. 14, with only 600 jobs expected to be created, a 70% drop.

The assumption here is that even the threat of tariffs won’t likely do much to bring furniture jobs back to the U.S. even in the foreseeable future. Our industry continues to compete with lower-cost labor that raises the perceived value of imported furniture versus domestically made furniture, although that’s a broad assumption that doesn’t factor in design and quality of construction or the use of quality materials. Nor does it factor in the advanced equipment used in furniture plants such as CNC routers to fabric cutting machines.

The report said, “It will be interesting to note how tariffs impact the under-reshored low-tech industries and products that are massively imported, the so-called off-the-shelf items such as clothing, furniture, toys, small electronics, toiletries etc. … Some analysts are predicting ‘Empty Shelves’ which will inevitably frustrate the public and aggravate inflation. In the event of an extended trade war, the U.S. is ill-equipped to fill in supply chain gaps for consumer goods, another unanticipated long-term offshoring inconvenience that will be difficult to correct.”

That said, it is worth noting some of the key factors driving both reshoring and FDI. In 2024, these were as follows: 1) government incentives 2) skilled workforce 3) proximity to market 4) supply chain risk 5) impact on domestic economy.

In 2025, the key factors identified include 1) proximity to market 2) government incentives 3) impact on domestic economy 4) skilled workforce 5) infrastructure and last but not least 6) tariffs

Other geopolitical factors also are considered drivers of reinvestment in U.S. manufacturing. For example, the study identified Russia’s invasion of Ukraine as accelerating investment from Europe to the U.S., driven largely by concerns over energy security. In 2021, it said there were 28,925 Western European origin job announcements compared with 36,127 last year.

Other geopolitical risk factors include U.S.-China tensions over Taiwan and an overdependence on China for sourcing, with an estimated 67% of reshoring cases reporting China as the country of origin.

The report added that workforce development is critical. “While manufacturing apprenticeships have increased by 83% over the last decade, the growing demand for skilled labor remains a major constraint to scaling reindustrialization efforts. … More automation, immigration of skilled workers, and recruitment and training of high school graduates will be necessary to increase output, improve competitiveness and fill the current job skills gap.”

A key question for the industry will be the level to which furniture jobs will return and how competitive the industry will be relating to offshore manufacturers. The report said manufacturing cost competitiveness is a key issue, as U.S. manufacturing costs are 10% to 50% higher than almost all competitor countries.

Tariffs certainly are a way to offset trade imbalances and perhaps bring some jobs back to the U.S. But the report said they must be applied to all countries to avoid loopholes, such as Chinese goods being shipped through Vietnam or Mexico, for example, and applied to all products. They also should be designed “for permanence to support long-term investment decisions and perhaps approved by Congress, so they cannot be easily overturned by the next president.”

For the full report, click here.