Nearly a third of those surveyed said they plan to buy bedroom furniture in the next 6 months

HIGH POINT — In our latest Consumer Insights Now report to be published this Monday, we look at bedroom furniture buying trends for the next six months.

Sponsored by American First Finance, the report has several key takeaways, including that some 29% of consumers surveyed plan to buy bedroom furniture during this period. And for those who have been developing product and marketing to younger consumers, the good news is that many of those consumers planning to buy bedroom fall within the 18-44-year-old age group.

For example, 41% of Gen Z consumers surveyed ages 18-28 said they plan to purchase primary bedroom, followed by 36% of younger millennials ages 29-36 and 32% who identified themselves as older millennials ages 37-44. Planning to buy at a slower rate were Gen X consumers ages 45-60 (26%) and baby boomers ages 61 and up (10%).

Some 25% identified themselves as homeowners and 37% identified themselves as renters, while the mix of incomes was roughly evenly split between those making under $50,000 a year (30%), those making $50,000 to $99,999 a year (28%) and those making over $100,000 (31%).

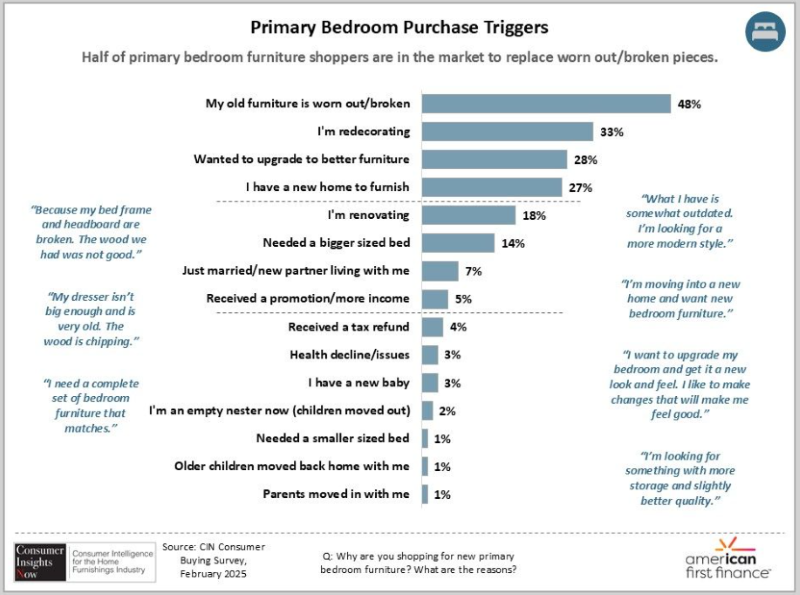

Also revealing is data that addresses the reasons people are seeking to purchase new bedroom furniture. A majority, or 48%, of those surveyed said their old furniture was worn out/broken, followed by 33% who said they are redecorating.

Twenty-eight percent said they wanted to upgrade to better furniture, and 27% said they had a new home to furnish.

Those last two points are key because they provide retailers an opportunity to sell multiple bedrooms, including a primary, second or guest bedroom or a child’s bedroom or nursery. We obviously credit retailers for knowing what questions to ask consumers coming through their doors, but this data in particular gives them additional information they may need to know for how to align their advertising/marketing dollars.

Another key takeaway is that people also are wanting to trade up in the category. That’s a huge opportunity for retailers to sell a larger ticket to a consumer that’s willing to spend. On that same note, some 14% of those surveyed said they need a bigger bed, likely moving from a queen to a king, for example. Or a full to a queen or king.

A vast majority (55%) of those surveyed also said they plan to spend between $1,000 and $3,499 on a bed, dresser, mirror and chest compared with 34% who said less than $1,000 and 11% who said more than $3,500.

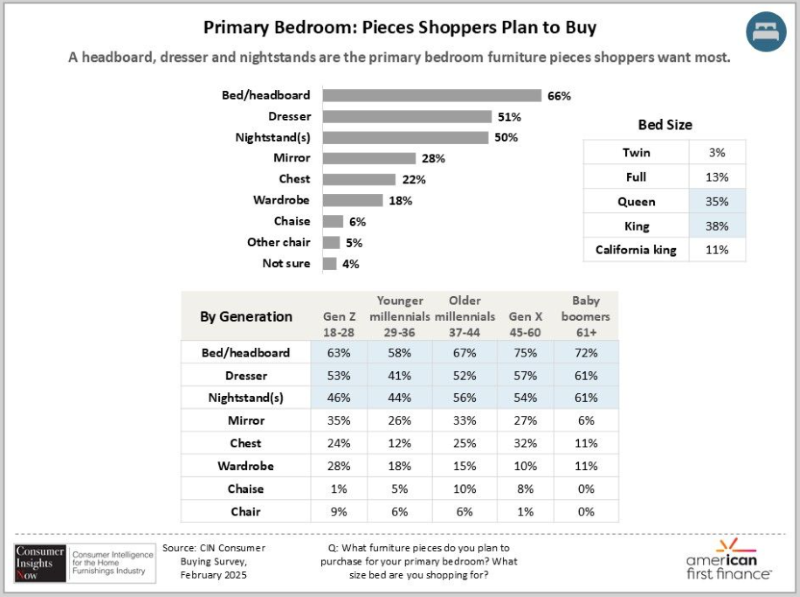

Also of note as shown in the chart below is what pieces take priority. For example, some 66% said they plan to buy a complete bed or headboard compared with 51% who said they want a dresser and 50% who want a nightstand.

The next most-sought-after item was the mirror, favored by nearly a third of those surveyed. The good news for those consumers is that many mirrors continue to complement the design elements of other pieces in a coordinated suite, making it fun to both shop and purchase.

Features also are important parts of the buying decision. For instance, 67% said that quality is the most important feature, followed by durability (61%), size (55%) and style/design (53%). This compares with color and wood type (39% and 34%, respectively), built-in storage and warranty (26% and 25%, respectively) and made in USA (20%). Further down the list were fully assembled (17%), made with sustainable materials (16%), USB/phone-charging capabilities (15%) and built-in lighting (12%).

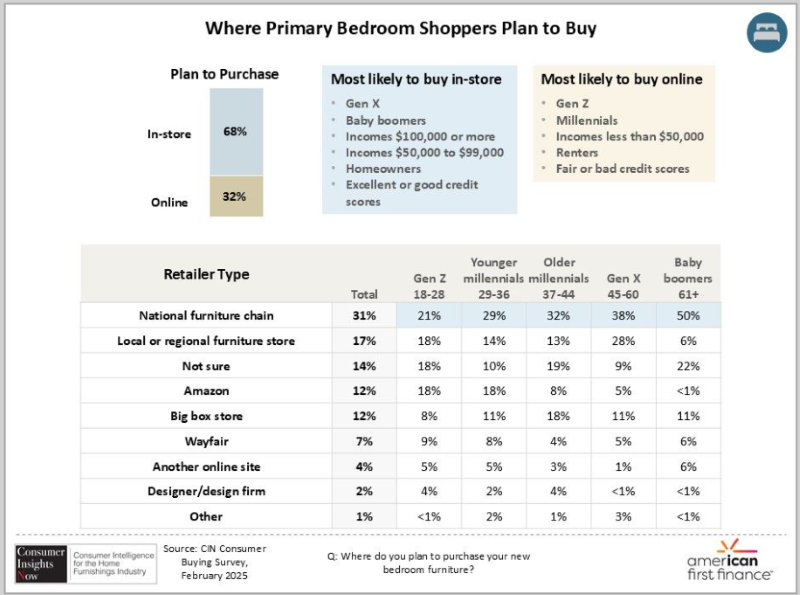

Lastly and perhaps the best news for retailers is that 68% of those surveyed said they plan to buy in-store versus 32% who said they plan to buy online. Those most likely to buy in-store include baby boomers, Gen X, those with incomes of $100,000 or more and those with incomes over $50,000 to $99,000, along with homeowners. Those leaning toward buying online include Gen Z and millennial consumers, those with incomes less than $50,000, and renters.

A further breakdown of this data is shown in the chart below.

As always, we hope this expertly prepared research proves useful in the weeks and months ahead, not only as you bring new product onto your floors, but also in how you market and distribute this product mix.

A second component of this week’s segment deals with dining room furniture, which we will break down in a deeper dive analysis next week.

Below is a summary of our publication schedule for Consumer Insights Now, including what we have published thus far and what’s coming up.

+ March 24 – Survey of new homeowners.

+ March 31 – Sofa shopping trends.

+ April 7 – Case goods shopping trends — primary bedroom and dining furniture.

+ April 14 – Mattresses for primary bedroom.

+ April 21 – High-end furniture shoppers and design report.