Monthly survey reflects growing concerns in the marketplace over tariffs

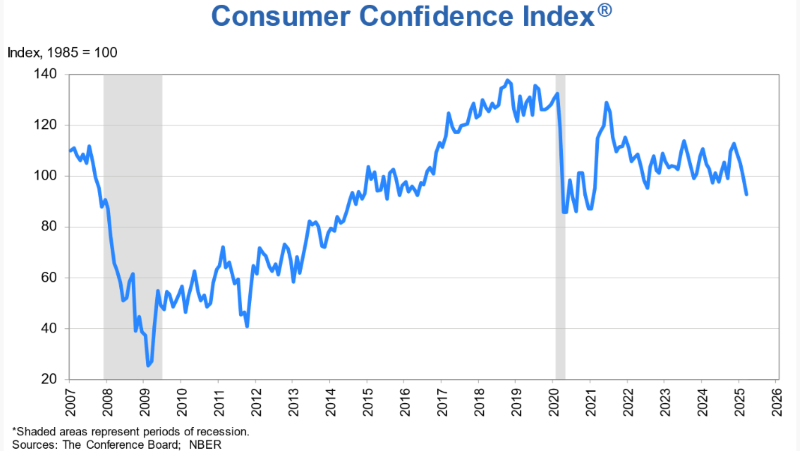

WASHINGTON — The Conference Board reported the Consumer Confidence Index fell 7.2 points this month, which marked the fourth consecutive monthly decrease, signaling consumers’ growing concerns about the economy.

The drop brought the index to 92.9, falling largely among consumers over age 55 and to a lower extent among those between 35 and 55. Officials noted that the decline was also broad-based across income groups, with the only exception being households earning more than $125,000 a year.

On a positive note, confidence rose slightly among consumers under 35, “as an uptick in their assessments of the present situation more than offset gloomier expectations.”

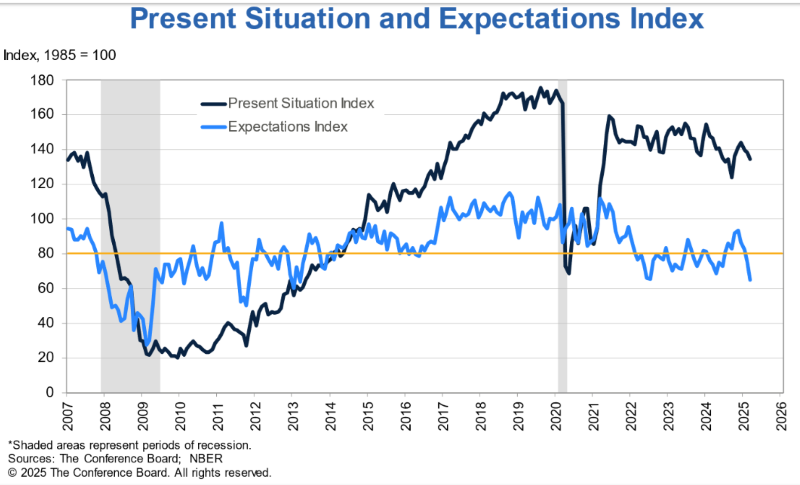

Meanwhile, the Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, fell 3.6 points to 134.5. The Expectations Index, which is based on consumers’ short-term outlook for income, business and labor market conditions, fell by 9.6 points to 65.2, which was the lowest level in 12 years and below the threshold of 80 that the Conference Board said typically signals a recession.

“Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022,” said Stephanie Guichard, senior economist, Global Indicators at the Conference Board. “Of the index’s five components, only consumers’ assessment of present labor market conditions improved, albeit slightly.

“Views of current business conditions weakened to close to neutral. Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low. Meanwhile, consumers’ optimism about future income — which had held up quite strongly in the past few months — largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations.”

On a six-month moving average basis, officials noted that purchasing plans for both homes and cars declined. However, intentions to buy large-ticket items — including appliances and electronics — rose, a sign that many planned to make purchases before potential tariffs lead to price increases.

The survey noted that consumers’ overall intentions to purchase additional services in the months ahead changed little, although “their priorities shifted.” For example, fewer consumers “planned to spend more on movies and live entertainment or sports, and more planned to spend on outdoor activities and travel. Vacation plans also increased.”

The survey also said that comments on the current administration and its policies, “both positive and negative, dominated consumers’ write-in responses on what is affecting their views of the economy.”

In addition, write-in responses showed that consumers are still highly concerned about inflation and that they are increasingly worried about the impact of trade policies and tariffs. The report said there also were more references than usual to economic and policy uncertainty.

Other highlights were as follows:

+ Consumers were negative about the stock market for the first time since late 2023, with only 37.4% expecting stock prices to rise in the year ahead, down nearly 10 percentage points from February and down 20 percentage points from a high point in November 2024. Some 44.5% expected stock prices to decline, up 11 percentage points from February and 22 percentage points higher than November.

+ Average 12-month inflation expectations rose from 5.8% in February to 6.2% in March, the board said, “as consumers remained concerned about high prices for key household staples like eggs and the impact of tariffs.”

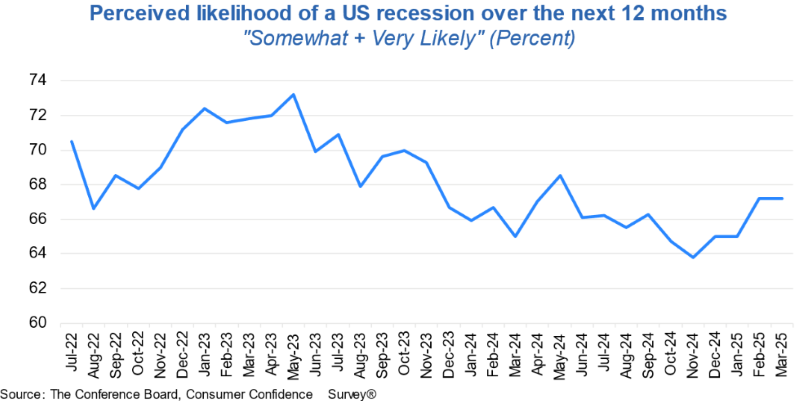

+ Consumers’ views of their family’s current financial situation improved slightly but their expectations for future finances declined to the lowest level since July 2022, with the share of consumers expecting a recession over the next year at a nine-month high.

+ Also the share of consumers anticipating higher interest rates over the next 12 months rose to 54.6% from 52.6% in February, while the share of those expecting lower rates declined to 22.4% from 24.1% in February.

Of their present situation assessment of current business conditions:

+ 17.7% of consumers said business conditions were good, down from 19.1% in February.

+ 16.6% said business conditions were bad, up from 14.8% in February.

Of the current labor market:

+ 33.6% of consumers said jobs were plentiful, unchanged from February.

+ 15.7% said jobs were hard to get, down from 16%.

Of their business conditions outlook six months from now:

+ 17.1% of consumers expected business conditions to improve, down from 20.8% in February.

+ 27.3% expected business conditions to worsen, up from 25.5% in February.

Of their outlook for the labor market:

+ 16.7% of consumers expected more jobs to be available, down from 18.8% in February.

+ 28.5% anticipated fewer jobs, up from 26.6% in February.

+ 16.3% of consumers also expected their incomes to increase, down from 18.8% in February.

+ 15.5% expected their incomes to decrease, up from 12.8% in February.