Company known for its sofa-sleepers has expanded to other upholstery products, plus dining and wood storage pieces

ONTARIO, Calif. — Within several short years, furniture resource Lilola Home has established a major presence in the e-commerce realm with a line of upholstery and living room furniture suited to a wide mix of consumer styles and preferences.

The company also has expanded in other categories including dining as well as wood storage pieces and even pet beds that hint at other emerging categories such as primary and secondary bedroom — not to mention rooms where pets get their rest. Other core categories include entertainment consoles, occasional tables and upholstered benches.

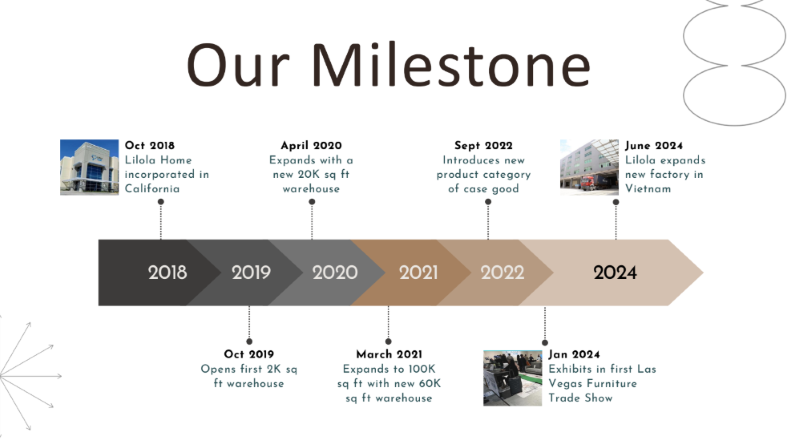

Its evolution, however, didn’t occur through typical industry channels. When it was started in the fall of 2018 by three former Acme Furniture veterans — John Chen, chief executive officer; Teresa Su, president; and Chad Ng, chief financial officer — it decided to initially focus on pure-play e-commerce.

It soon established itself as a leading supplier of sofa-sleepers, its No. 1 category, followed by other upholstery, including sectionals and modular upholstery, that offered functionality in the stationary realm ranging from storage to charging capability for electronics.

“We started in e-commerce and thus started building our product spec sheets from the ground up,” Chen said, adding that packaging was another key area of development. “So once we were established with e-commerce, we took that formula and brought it to brick and mortar. Of course we had to also change the SKUs that we presented, so in the two years since we started selling brick and mortar, we transitioned ourselves from e-commerce, which is small parcel, to larger products such as sectionals, because when people shop in stores, they expect larger products.”

Its distribution thus has begun to shift as it started to sell brick and mortar in 2023. Today, 65% of its business is done in e-commerce versus 35% in brick-and-mortar stores as the company is positioning itself for further traditional retail distribution. For example, it looks for the brick-and-mortar channel to grow to 40% of its business by the end of 2025 and to 45% in 2026.

“While it’s an ambitious target, we’re confident in the strategies we’ve put in place to achieve this growth,” Chen told Home News Now.

The strategy follows several core tenets that the company has put in place to help define its focus and place in the market.

These include:

+ A focus on developing designs for Gen X, millennials and Gen Z consumers, “offering timeless yet trend-conscious designs.”

+ Quality and affordability: “Lilola Home is committed to delivering high-quality products at prices that are accessible for a wide range of customers,” both domestically and internationally.

+ Sustainability: “We prioritize environmentally friendly materials, such as vegan leather and recycled paper veneer, as alternatives to marble, quartz and solid wood.”

+ Leadership in product innovation: “As one of the top U.S. manufacturers and suppliers of sleeper-sofas and sectionals, we pride ourselves on introducing innovative designs and features in stationary upholstery.”

The company also has evolved its shipping model, particularly as the shift to larger SKUs took shape. Initially starting with a container-direct shipping model, the company also offered drop-shipping services for large e-commerce accounts.

And in October 2019, it opened a 2,000-square-foot warehouse in the Ontario, California, area where the company is based that grew to 20,000 square feet about six months later. Fueled by a spike in demand during Covid, the warehouse grew to 100,000 square feet by March 2021.

Today, with a line that has grown to more than 1,300 SKUs, its Ontario warehouse is about 175,000 square feet. It also ships from third-party warehouse and distribution facilities in Miami and Dallas that bring its total distribution to about 350,000 square feet.

The company also has the support of a diverse manufacturing network in Asia, with manufacturing partners in China, Vietnam, Malaysia and Taiwan.

Industry veteran Andy Bush, who first joined the company as executive vice president of business development in June 2024, first met the Lilola team several year ago when he was at eSolutions Furniture Group, also previously known as Bush Furniture.

One of the things that impressed him about the company was the entrepreneurial spirit of its young executive team, who were all under 40.

“What attracted me was less about what they are and was more about what I saw they could become,” Bush said, adding that he also was drawn to the different path they have taken to success. “They started out right before Covid in e-commerce. It wasn’t like they had been around 10, 15 or 20 years selling brick and mortar. They started in e-commerce, so it was almost a trial by fire. Arguably, in some ways, the day-to-day business of e-commerce is a heck of a lot harder than it is in brick and mortar. The sell-in process is difficult. … But over time, you can build and adjust your strategy because you can take the product and values that you have and still make it work in the (brick-and-mortar) furniture channel.”

“They grew so fast and so quickly and were able to grow the infrastructure a lot faster than other companies,” Bush added. “They had that push behind them with Covid.”

To support its growth now and in the future, Lilola Home also has developed a sales force that today includes about 20 reps, including four internationally.

With that network in place, along with the industry experience of Andy Bush in business development, the company is looking to broaden its market penetration at the same time it increases its expertise in categories ranging from sofa-sleepers to dining and more.

“We have already established ourselves as a brand in the e-commerce world, and our goal now is to pursue the sales we don’t have,” Chen said of the brick-and-mortar channel. “We started from zero, working from the ground up, and having Andy here will really help us from a macro perspective, not as a small business, but how do we get to that next level of $100 million or more in the next few years.”