Purchase Applications Payment Index shows a 1.3% decrease from July, meaning consumers could have additional money for things like furniture

WASHINGTON — Homebuyer affordability rose for the fourth straight month in August, creating slightly more breathing room in consumers’ budgets for things like furniture and other durable goods.

According to the Mortgage Bankers Association’s Purchase Applications Payment Index, the national median mortgage payment decreased to $2,100 in August from $2,127 in July.

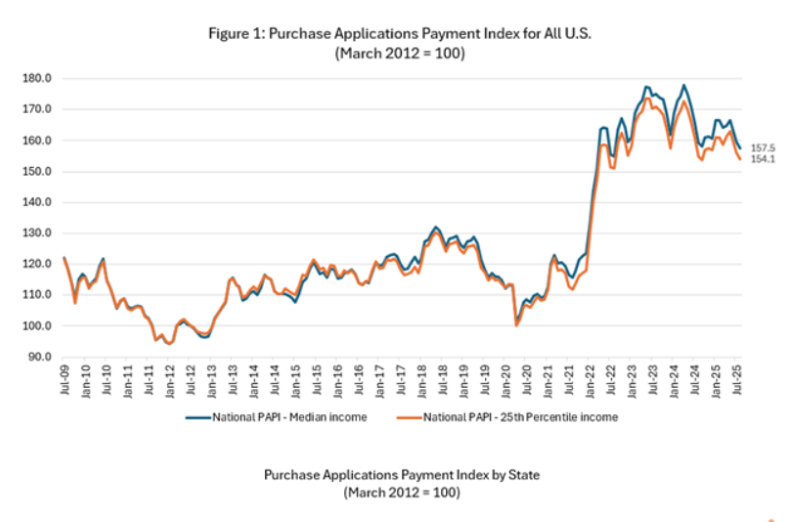

Using data from the MBA’s Weekly Applications Survey, the PAPI index measures new monthly mortgage payments relative to consumer income.

The national median mortgage payment was $2,211 this past May, meaning the August index was $111, or 5% less than the May rate.

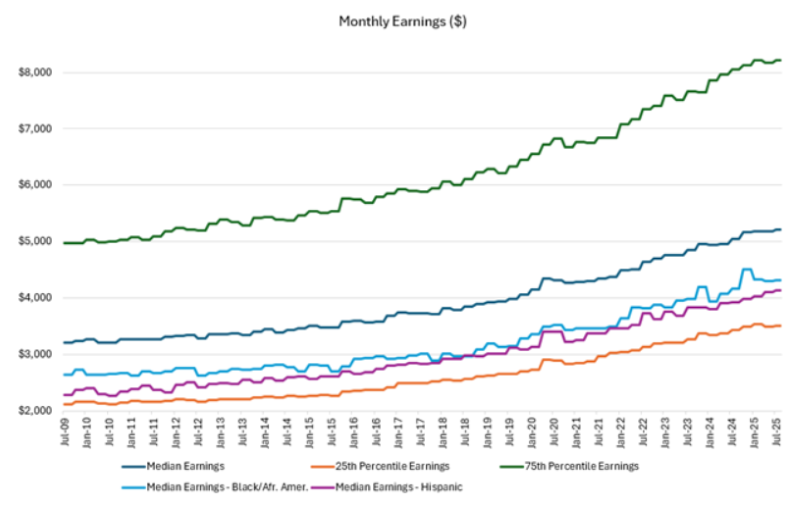

“Affordability conditions have improved for four straight months, with lower mortgage rates and stronger income growth boosting prospective buyers’ purchasing power,” said Edward Seiler, MBA’s associate vice president of Housing Economics and executive director of the Research Institute for Housing America. “MBA is expecting that moderating home-price appreciation, coupled with lower rates, will continue to ease affordability constraints and help to boost activity in the housing market.”

A decrease in the PAPI — which indicates improving borrower affordability conditions — occurs when loan application amounts decrease, mortgage rates decrease or earnings increase. Meanwhile an increase in the index translates into mortgage payment to income ratio being higher because of increasing application loan amounts, rising mortgage rates or a decrease in earnings.

The MBA said that the national PAPI decreased 1.2% to 157.5 in August from 159.4 in July. Meanwhile, median earnings rose 3.2% compared to one year ago. It also noted that for borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment declined to $1,445 in August from $1,468 in July.

The report also noted that the Builders’ Purchase Application Payment Index showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey decreased to $2,210 in August from $2,233 in July.

While these decreases might seem minimal, they also lessen the monthly spend toward a mortgage. Combined with income levels, this can encourage people to shop for more durable goods such as furniture.

Other highlights of the report were as follows:

+ The national median mortgage payment was $2,100 in August — down $27 from July. However, this was up $43 from one year ago, a 2.1% increase.

+ The national median mortgage payment for FHA loan applicants was $1,863 in August, down from $1, 865 in July, but up from $1,817 in August 2024.

+ The national median mortgage payment for conventional loan applicants was $2,112 in August, down from $2,160 in July but up from $2,056 in August 2024.

+ The top five states with the highest PAPI were: Idaho (256.5), Nevada (241.9), Arizona (214.0), Rhode Island (208.3) and Utah (205.0).

+ The top five with the lowest PAPI were: Alaska (115.1), Louisiana (115.3), D.C. (117.2), Connecticut (121.7) and New York (123.6).

+ Homebuyer affordability increased for Black households, with the national PAPI decreasing from 158.9 in July to 156.9 in August.

+ Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 148.5 in July to 146.6 in August.

+ Homebuyer affordability increased for white households, with the national PAPI decreasing from 160.5 in July to 158.5 in August.