More than 70% of those surveyed prefer to shop in-store versus online, but higher numbers of younger consumers say they prefer the online experience

HIGH POINT — Brick-and-mortar retailers will be pleased to know that most consumers prefer shopping for furniture in-store versus online.

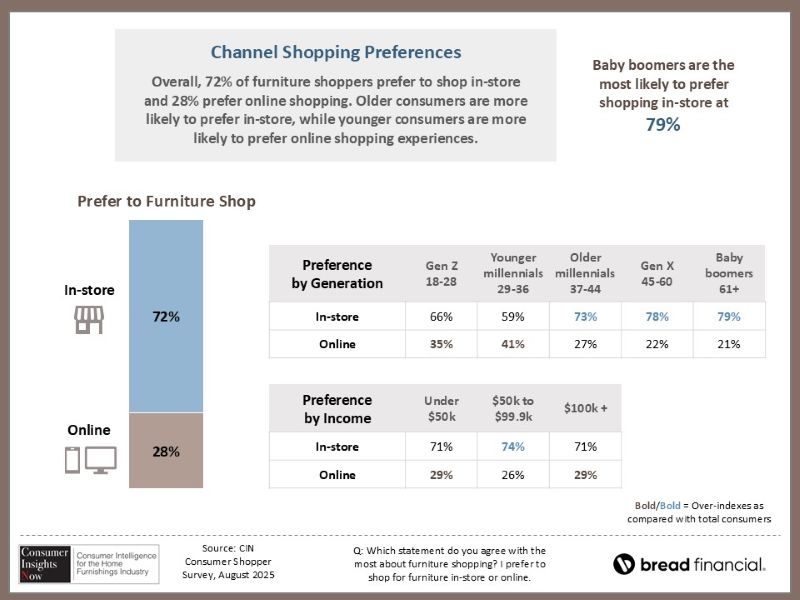

According to our latest Consumer Insights Now research, sponsored by Bread Financial, overall, 72% of furniture shoppers prefer to shop in-store, while 28% prefer online shopping.

However, a higher percentage of younger consumers are more likely to prefer shopping online, while older consumers more likely prefer the in-store experience. For example, 35% of Gen Z consumers ages 18-28 and 41% of younger millennials ages 29-36 said they preferred to shop online, compared with 27% of older millennials ages 37-44, 22% of Gen X ages 45-60 and 21% of baby boomers ages 61 and up.

Another interesting stat notes that 64% of consumers who prefer to shop in-store say they only buy furniture when it is a need, compared with 58% of furniture shoppers who shop online. Thus, the online shopping experience results in more impulse buys.

Of those who prefer to shop in-store, 92% said they are willing to take time to shop multiple retailers, compared with 89% who prefer to shop online, while 31% who shop in-store said they were influenced by social media influencers, compared with 42% of those who prefer to shop online. Also, 57% of those who shop in-store said they like to ask sales associates for help/advice compared with 43% who shop online.

Hence, this gives a window into the mindset of the consumer, whether shopping in-store or online. Retailers also likely will benefit from knowing some key reasons shoppers prefer each platform.

For example, shoppers like the in-store experience for the ability to see, touch and experience furniture firsthand and also determine if it’s comfortable. They also like being able to gauge the quality and size of the furniture while also seeing fabrics and finishes up close. In addition, they like being in a “fun atmosphere” and the ability to receive help from a salesperson when needed.

Nearly 90% also perceive furniture sold in-store as being higher quality, compared with 87% who said they believe brick-and-mortar stores offer a large selection, 84% who said salespeople are welcoming and helpful, 82% who said that furniture is delivered quickly and 70% who said prices are reasonable. And 69% said they want to establish a “relationship with the store for warranty and service after the purchase.”

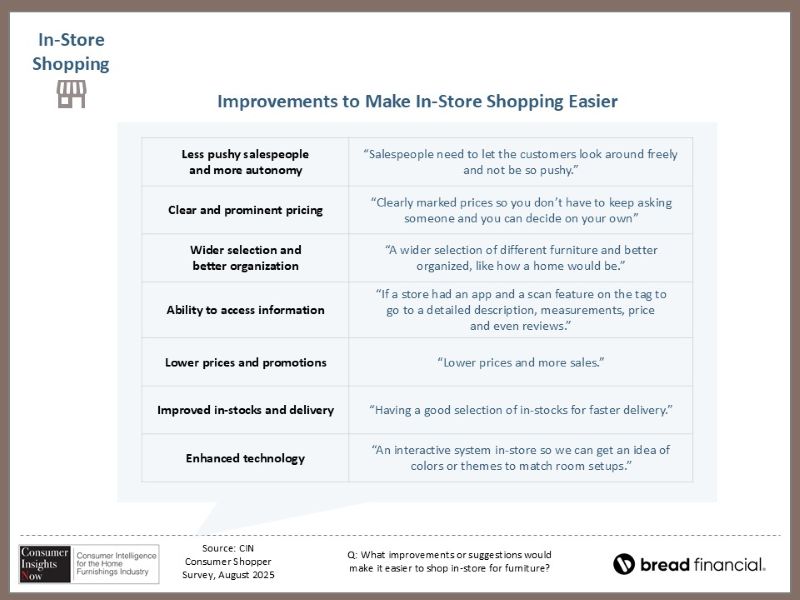

However, there are some negatives: 62% surveyed perceived prices as high and 45% perceived salespeople as pushy.

Below is a chart showcasing what people said would make the in-store shopping experience easier.

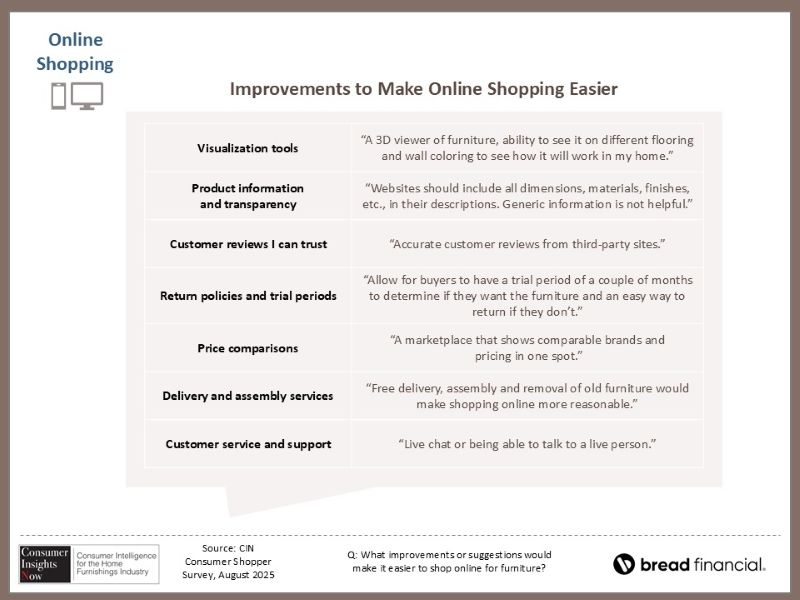

Compare this with what consumers prefer about the online furniture shopping experience. Some 95% perceived there was a wide selection to choose from, compared with 82% who said prices are reasonable (compared with 70% who said the same about in-store) and 79% who said that the furniture is delivered quickly.

Nearly three-quarters, or 74%, perceived the furniture to be of high quality (compared with 90% who said the same about furniture sold in-store), and 46% perceived prices to be high (compared with 62% who perceived prices to be high at brick-and-mortar stores).

The chart below provides insights from consumers regarding the online shopping experience including what would make that shopping experience easier.

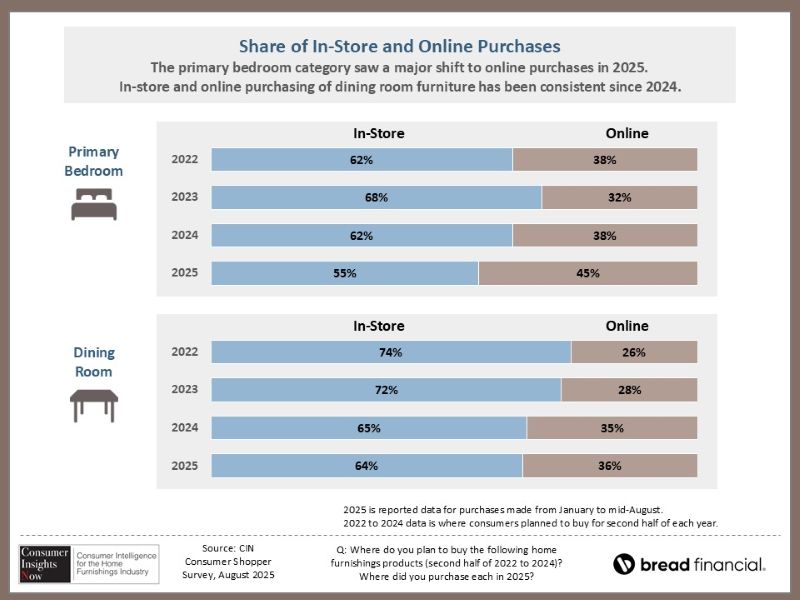

Primary bedroom was among the categories that saw a major shift to online purchases this year, with 45% saying they purchased a bedroom online this year, compared with 38% last year. Dining was fairly stable with 36% surveyed saying they purchased a dining set online this year compared with 35% last year.

Some 21% of those surveyed said they purchased a sofa online, compared with 24% last year, while 29% said they purchased a recliner online this year versus 24% last year.

Some 39% of those surveyed said they purchased occasional tables online this year compared with 38% last year.

For the full report, click here.

As always, we hope this research helps you understand the needs and wants of your customer base. Armed with such information, we believe your store will have an advantage in providing the right products and services among different age groups and income levels. Without it, a competitor, whether in your backyard or online, could eat into a significant part of your business.

Below is the full five-week schedule of this season’s Consumer Insights Now reports. For a video interview with Home News Now Editor-in-Chief Tom Russell speaking with our research expert Dana French about the project, click here.

+ Sept. 15 – Furniture Shopper Perceptions About the Economy.

+ Sept 22 – The Shopping Journey and Motivators for Consumer Furniture Purchases.

+ Sept. 29 – Needs and Driving Factors for Consumers Shopping for Furniture.

+ Oct. 6 – Buying In Store Versus Online.

+ Oct. 13 – Motivations and Attitudes of Today’s Consumers.