Sales also declined 8.4% from December, according to National Association of Realtors

WASHINGTON — Existing home sales declined in all major regional markets in January compared with January of 2025. They also declined in all regions compared with December, according to recently released data from the National Association of Realtors.

Year-over-year sales decreased 4.4% to 3.91 million in January and also declined 8.4% compared with December, the NAR reported.

Single-family home sales totaled 3.53 million, or 90.3% of the total, down 4.3% from January 2025 and down 9% from December. The total median single-family home price was $400,300, up .6% from January 2025.

Condominium and co-op sales totaled 380,000, down 5% from January 2025 and down 2.6% from December. The median price was $364,000, up 3.8% from January 2025.

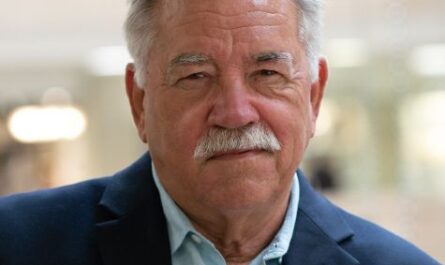

“The decrease in sales is disappointing,” said NAR Chief Economist Lawrence Yun. “The below-normal temperatures and above-normal precipitation this January make it harder than usual to assess the underlying driver of the decrease and determine if this month’s numbers are an aberration.”

There were 1.22 million units on the market, up 3.4% from 1.18 million in January 2025 and down .8% from December. The NAR said this represents a 3.7-month supply of unsold inventory, up from 3.5 months in December and one year ago.

The good news is that the NAR’s Housing Affordability Index rose to 116.5 in January, up from 102 in January 2025 and up from 111.6 in December 2025.

The median home price was $396,800, up .9% from January 2025, marking the 31st consecutive month of year-over-year increases. However, affordability increased across all regions. For example, it improved 9% in the Northeast, 12.2% in the Midwest, 15.2% in the South and 17.1% in the West.

“Affordability conditions are improving, with NAR’s Housing Affordability Index showing that housing is the most affordable it’s been since March 2022,” Yun said. “This is due to wage gains outpacing home price growth and mortgage rates being lower than a year ago. However, supply has not kept pace and remains quite low.”

“Due to low supply, the median home price reached a new high for the month of January,” Yun added. “Homeowners are in a financially comfortable position as a result. Since January 2020, a typical homeowner would have accumulated $130,500 in housing wealth.”

By region, the activity was as follows:

In the Northeast, existing home sales totaled 480,000, down 4% from January 2025 and down 5.9% from December. The median price was $505,400, up 5.8% from January 2025.

In the Midwest, home sales totaled 920,000, down 7.1% from January 2025 and down 7.1% from December. The median price was $295,400, up 2.3% from January 2025.

In the South, home sales totaled 1.81 million, down 1.6% from January 2025 and down 9% from December. The median price was $351,200, up .1% from January 2025.

In the West, home sales totaled 700,000, down 7.9% from January 2025 and down 10.3% from December. The median home price was $600,400, down 1.4% from January 2025.

Other takeaways from the report were as follows:

+ The average 30-year fixed rate mortgage was 6.1% in January, down from 6.96% in January 2025 and down from 6.19% in December.

+ Homes were on the market for 46 days in January, up from 41 days in January 2025 and up from 39 days in December.

+ 31% of sales were first-time homebuyers, up from 28% in January 2025 and up from 29% in December.

+ 27% of transactions were cash sales, down from 29% in January 2025 and 28% in December. Also, 16% of transactions were individual investors or second-home buyers, down from 17% in January 2025 and down from 18% in December.

+ 2% of sales were distressed sales including foreclosures and short sales, down 3% from January 2025 and unchanged from December.

With winter weather continuing to be a factor in consumers’ desire to look for a home, it’s unclear whether the February report will see much improvement. Warmer weather spring and summer months are typically better for home sales, and also furniture buying.

But should affordability continue to improve for existing and new homes, this could benefit the home furnishings industry as improved consumer spending power for major purchases like furniture also will improve. The numbers continue to bear watching because of their potential positive impact on furniture sales now and in the months ahead.