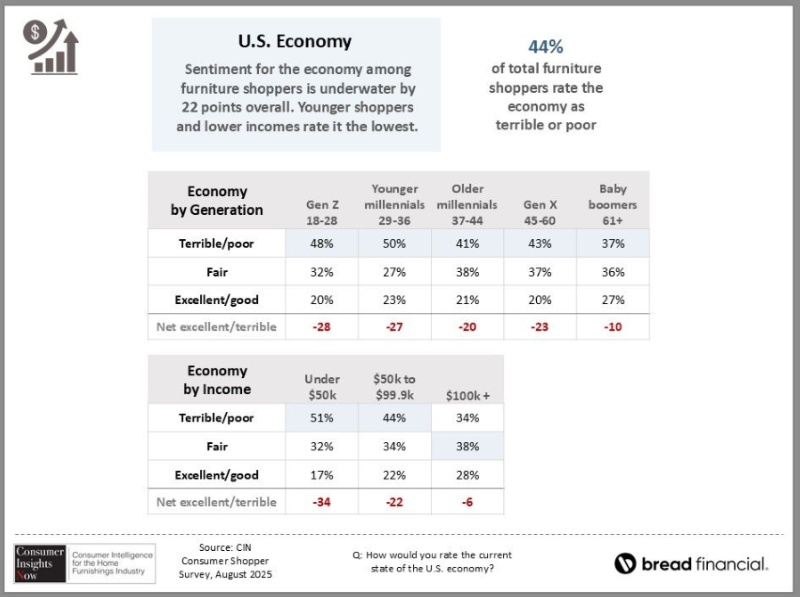

More than 75% of all prospective furniture shoppers view economic conditions as poor or fair, which could impact their decision to buy in the 2nd half

HIGH POINT — This coming Monday marks the start of five successive weeks of the next installment of our Consumer Insights Now research that offers a window into consumer planned purchases plus additional insights into how they view the broader economy.

Our first report focuses on the economy, offering a mix of good and bad news. The bad news is that 44% of furniture shoppers rate the economy as terrible or poor compared with 32% who view it as fair. Only 22% viewed it as excellent or good.

Also, some seven out of 10 shoppers have delayed a furniture purchase because of current economic conditions, with tariffs being one area of concern.

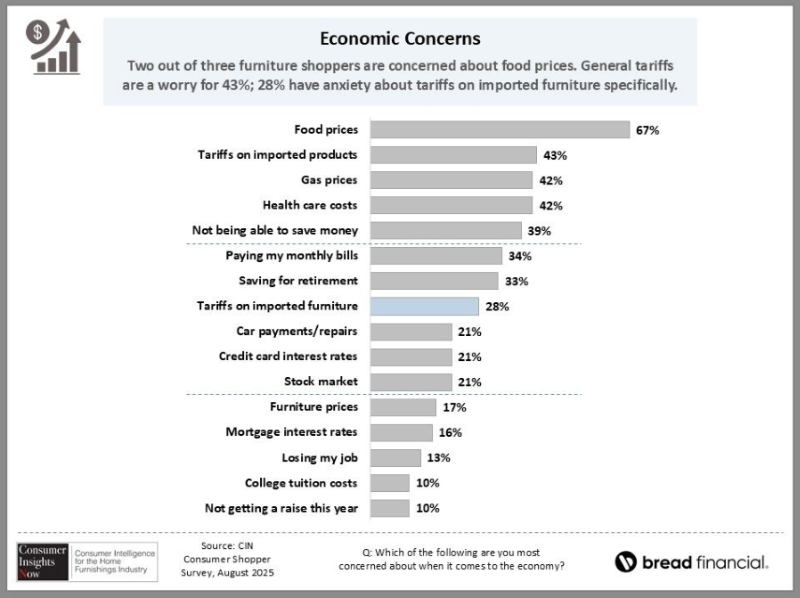

Food prices actually topped the list of concerns across every generation including Gen Z, ages 18-28; younger millennials, ages 29-36; older millennials, ages 37-44; Gen X, ages 45-60; and baby boomers, ages 61 and up. Overall, food prices were a concern for 67% of those surveyed, followed by 43% who were concerned about tariffs on imported products. Understanding the amount of furniture that is imported, some 28% surveyed said they were concerned about tariffs on imported furniture.

Gas prices and health-care costs were a concern for 42% of those surveyed, compared with not being able to save money (39%), paying monthly bills (34%) and saving for retirement (33%). By comparison, furniture prices were a concern overall for 17% of those surveyed, which means one of two things: Either they are in the market for furniture or they simply aren’t.

In addition, consumers’ overall perception of prices for home furnishings is that they have gotten higher, with roughly half of those surveyed saying they believe costs have risen this year compared with previous years.

For example, 65% of those in the market for mattresses say prices are higher in the category compared with dining furniture (58%), lighting (57%), sofas (55%), outdoor furniture (53), area rugs and office furniture (52%), lamps (51%) and home entertainment (50%). Other categories perceived as more expensive include recliners (47%), primary bedroom furniture (46%) and occasional tables (41%).

Overall, some 62% believe that furniture prices are higher in brick-and-mortar stores, compared with 46% who believe this to be the case online.

Largely because of tariffs and related pricing issues, many consumers are planning to put some furniture purchases on hold including some 60% of Gen Z consumers, 53% of younger millennials and 51% of older millennials. This compares with 48% of Gen X and 37% of baby boomers. The percentage of those planning to delay purchases also depends on income levels, including some 42% of those making more than $100,000, 48% of those making $50,000 to $99,999 and 57% of those making under $50,000.

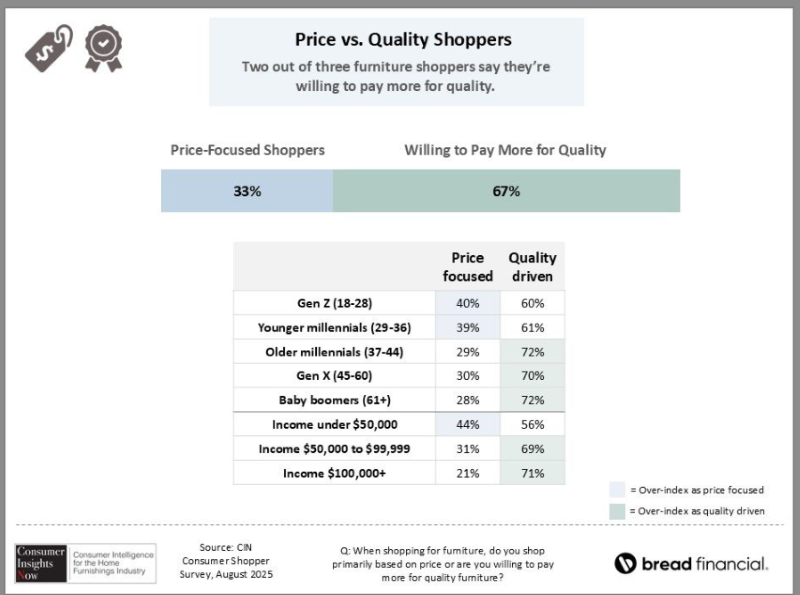

The good news is that some 67% of those looking to buy furniture are willing to spend more for quality, compared with 33% who are more focused on price. Higher age groups are more likely to spend more for quality, with younger consumers being more price driven. The same is true for those with higher income levels.

Also, older consumers still plan to buy what they had planned in spite of tariffs, including 45% of older millennials, 46% of Gen X and 57% of baby boomers — compared with 33% for Gen Z and 38% for younger millennials. Another silver lining? — The relatively high numbers across generations show there are still many in the market for furniture.

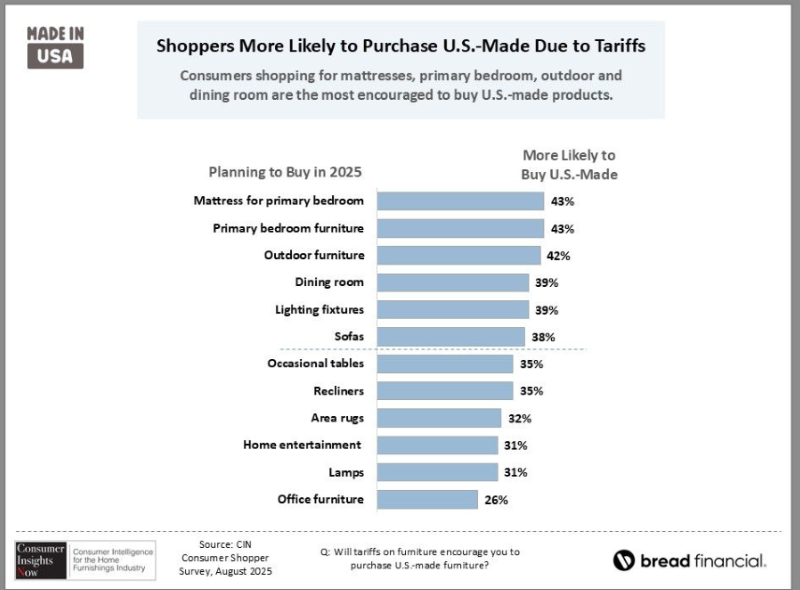

The survey also has good news for domestic furniture manufacturers with 35% of those surveyed saying that tariffs will encourage them to purchase U.S.-made furniture. Top preferred categories for domestic include mattresses for the primary bedroom and primary bedroom furniture (43%), outdoor furniture (42%), dining furniture and lighting fixtures (39%) and sofas (38%).

These are just some of the insights conveyed in our report on consumer views of the economy. Together, they let retailers and wholesalers alike understand the consumer mindset and how perhaps they might tailor their products or services to the needs of those shoppers. As always, we hope such information allows the industry to make these types of informed decisions, particularly as we approach the fall market cycle.

Below is a quick recap of our publishing cycle for the fall edition of Consumer Insights Now:

+ Sept. 15 – Furniture Shopper Perceptions About the Economy.

+ Sept 22 – The Shopping Journey and Motivators for Consumer Furniture Purchases.

+ Sept. 29 – Needs and Driving Factors for Consumers Shopping for Furniture.

+ Oct. 6 – Buying In Store Vs. Online

+ Oct. 13 – Motivations and Attitudes of Today’s Consumers