Responsibility for packaging waste will be shifted away from consumers and municipalities and onto the companies that put products into commerce

COLFAX, N.C. — At the American Home Furnishings Alliance’s recent regulatory and sustainability forum, Alex Williams, AHFA’s manager of sustainability and regulatory affairs, urged furniture companies to prepare now for the rapid expansion of Extended Producer Responsibility laws across the U.S. — with packaging as the first major target.

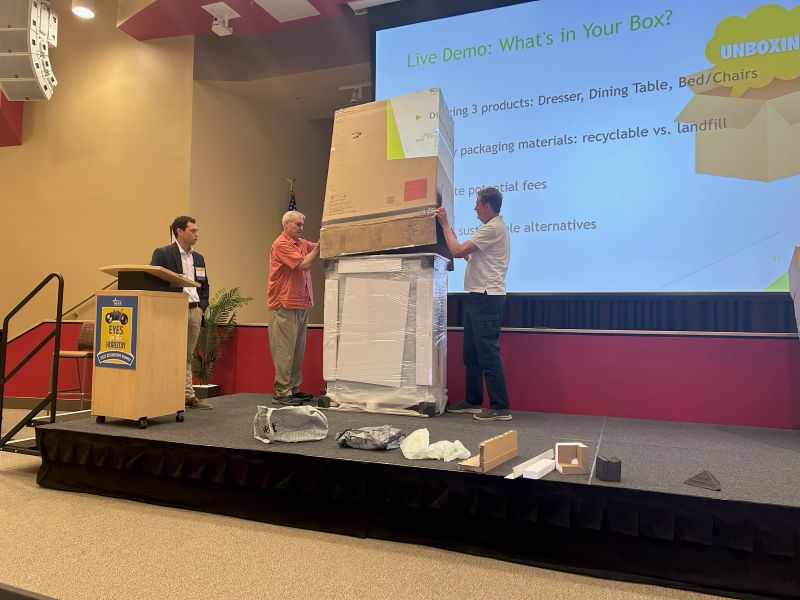

Williams framed the issue with a simple takeaway: “Know what’s in your box.” In other words, every material used in furniture packaging — from corrugated cartons and plastic wrap to straps, inserts and even instruction manuals — will soon be subject to reporting, fees and potential redesign requirements under state EPR programs.

What is EPR?

Extended Producer Responsibility shifts responsibility for packaging waste away from consumers and municipalities and onto the companies that put products into commerce. Instead of relying on households to recycle, manufacturers, importers and brand owners must share in the end-of-life management of packaging.

Williams explained that while EPR has been the norm in Europe and Canada for decades, the U.S. is only now beginning to adopt it. Oregon became the first state to implement a packaging EPR law in 2021, followed by Colorado, California and Maine. Several others — including New York, New Jersey, Illinois, Washington and Minnesota — are advancing legislation.

Each state has its own definitions, covered materials, reporting requirements and fee structures, creating a patchwork of obligations that Williams said will only become more complicated. California’s version is especially strict, requiring companies to break down every packaging component by material type and prove recyclability or compostability by specific deadlines.

Why furniture is in the crosshairs

For furniture makers, the implications are significant. Packaging is bulky, multi-material and often customized for protection during shipping, particularly for ready-to-assemble and e-commerce channels. That complexity will translate into higher reporting burdens and higher fees.

Some materials — such as expanded polystyrene, plastic film and even certain coated papers — are being priced at much higher per-pound rates to discourage use. Corrugated cardboard, by contrast, is emerging as the most cost-effective option under most EPR frameworks.

Williams cited examples outside the industry to illustrate how companies are adapting. Nike, for instance, has tested algae-based ink for packaging and branding, an innovation that reduces reliance on petroleum-based dyes.

Chick-fil-A, long reliant on Styrofoam cups, has transitioned to alternatives to avoid penalties and reputational risk. Furniture companies, he suggested, should expect similar scrutiny — and similar pressure to phase out problematic materials.

Who’s responsible?

The nonprofit Circular Action Alliance, backed by major corporations including Amazon, Walmart and Target, has been designated as the producer responsibility organization in Oregon and Colorado and is expected to manage other state programs as they launch.

Producers must register through the CAA portal, report the types and weights of their packaging materials sold into each state, and pay fees based on that data. Failure to register or misreporting can result in penalties, and Williams warned that regulators intend to make examples of noncompliant companies.

Determining who qualifies as the “producer” is not always straightforward. Depending on the business model, the responsible party could be the brand owner, the importer or even a licensee. Companies selling direct-to-consumer, private label or through white-glove delivery all face different obligations. Williams urged furniture companies to carefully analyze their distribution chains to determine where reporting responsibility falls.

The cost of compliance

Fees will vary, but Williams suggested that furniture suppliers budget roughly 1% of sales to cover packaging EPR costs. That figure could increase depending on materials used and whether companies qualify for bonuses or reductions tied to sustainability efforts. Some programs offer incentives for companies that conduct lifecycle assessments, use compostable packaging or design for recyclability.

Getting ready: a seven-step plan

To help companies prepare, Williams outlined a seven-step approach:

- Audit packaging materials — inventory every component, no matter how small.

- Map your supply chain — determine who owns responsibility at each stage.

- Engage with the Circular Action Alliance — register early and understand reporting expectations.

- Evaluate data tools — manual reporting may not be sustainable as laws expand.

- Design with recyclability in mind — consider material substitutions now.

- Train internal teams — sustainability and compliance must work hand in hand.

- Plan for continuous change — expect the rules to evolve.

The ultimate goal, Williams said, is to reduce landfill waste and align packaging with the principles of the circular economy — where materials are designed for reuse, recycling or composting from the outset.

“EPR is coming, whether we like it or not,” Williams told the audience. “The question for our industry is not if, but how well we’re prepared to demonstrate what’s in the box — and to prove that it’s as sustainable as possible.”

by

by