However, building permits and home completions were down over the same year-over-year period, according to numbers released by the Department of Commerce this week

WASHINGTON — Housing starts had a rousing boost in July, rising nearly 13% from a year earlier, according to figures released by the U.S. Department of Commerce this week.

However, building permits and housing completions were down over the same year-over-year period, the numbers showed.

Housing starts totaled 1,428,000, 12.9% above 1,265,000 in July 2024 and 5.2% above a revised June estimate of 1,358,000. Of these, 939,000, or 65.7% of the total, were single-family homes, up 2.8% from a revised June figure of 913,000.

By comparison, building permits issued fell by 5.7% to 1,354,000, from 1,436,000 and fell by 2.8% from a revised June rate of 1,393,000. Of these, there were 870,000 single-family authorizations, or 64.3% of the total, and 0.5% above the revised June figure of 866,000.

Residential housing completions totaled 1,415,000 for the month of July, which is 13.4% below 1,635,000 in July 2024. Of these, 1,022,000, or 72.2% of the total, were for single-family homes, 11.6% above the revised June rate of 916,000.

The balance in each of the three above scenarios were buildings with five or more units.

The National Association of Home Builders tempered some of the positive news about housing starts with its own analysis. For example, it noted that the July reading of 1.43 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, it noted, single-family starts increased 2.8% to a 939,000 seasonally adjusted annual rate and are down 4.2% on a year-to-date basis.

By comparison, it said, construction activity on apartment buildings and condos rose 9.9% to an annualized 489,000 pace.

The NAHB added that the slowdown in single-family homebuilding has narrowed the homebuilding pipeline, noting that there are about 621,000 single-family homes under construction, down 1% in July and 3.7% lower than a year ago. “This is the lowest level since early 2021 as builders pull back on supply,” the NAHB said.

“Single-family production continues to operate at reduced levels due to ongoing housing affordability challenges, including persistently high mortgage rates, the skilled labor shortage and excessive regulatory costs,” said Buddy Hughes, chairman of the NAHB and a home builder and developer from Lexington, North Carolina. “These headwinds were reflected in our latest builder survey, which indicates that affordability is the top challenge to the housing market.”

“The slowdown in single-family homebuilding has narrowed the homebuilding pipeline,” added NAHB Chief Economist Robert Dietz.

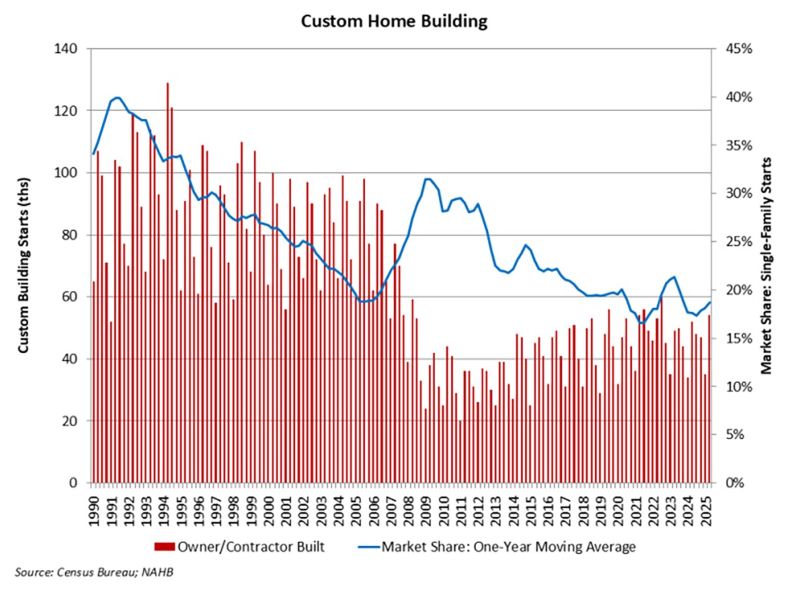

However, in a separate analysis of Census Data from the Quarterly Starts and Completions by Purpose and Design survey, the NAHB found there has been “year-over year growth for custom homebuilders amid broader single-family homebuilding weakness.”

“The custom building market is less sensitive to the interest rate cycle than other forms of homebuilding, but is more sensitive to changes in household wealth and stock prices,” NAHB said. “With spec home building down and the stock market up, custom building is gaining market share.”

For example, it said, there were 54,000 total custom building starts during the second quarter of 2025, up 4% from the second quarter of 2024. Over the last four quarters, it noted, custom housing starts totaled 184,000 homes, or slightly over a 2% increase compared to 180,000 in the prior four-quarter total (180,000).

Custom homes tend be more expensive as they feature custom build features selected by the buyer.

Regional year-over-year home construction activity is as follows, according to the new residential construction report:

+ New building permits issued in July were down 43.6% in the Northeast, down 7.7% in the Midwest, up 6.5% in the South and down 22.4% in the West.

+ Year-over-year housing starts were down 35.5% in the Northeast, up 40.8% in the Midwest, up 29.5% in the South and down 14.4% in the West.

+ Housing completions were up 18.3% in the Northeast, down 13.2% in the Midwest, down 11.9% in the South and down 25.6% in the West.

The NAHB noted that on a regional and year-to-date basis, combined single-family and multifamily starts were 10.2% higher in the Northeast, 17.7% higher in the Midwest, 2.4% lower in the South and 0.5% lower in the West.

It added that based on regional permit data on a year-to-date basis, permits were 16.6% lower in the Northeast, 9.1% higher in the Midwest, 3.4% lower in the South and 5.1% lower in the West.