More than half of those surveyed plan to buy a sofa or sectional in the next several months

HIGH POINT — Once again, upholstery rules as the N0. 1 product category sought by consumers, including those who have moved or are moving into a new home.

That major life event is a central theme in this latest installment of Consumer Insights Now, sponsored by American First Financial. Fielded among 1,200 consumers Feb. 10-13, the survey includes a mix of men and women ages 18-79 of different generations, ethnicities and household incomes that plan to buy furniture through early July.

In this segment, the survey focused on purchases of sofas and sectionals, both leather and fabric, as well as the stationary and motion categories.

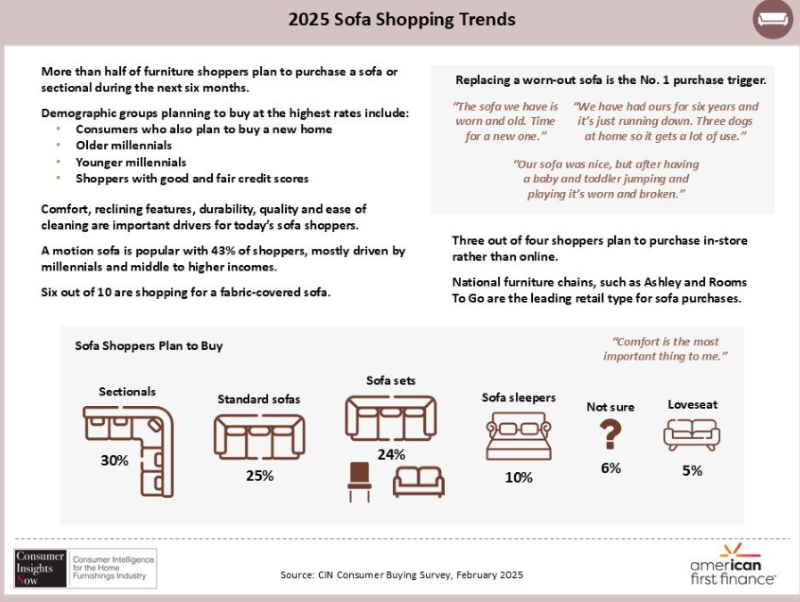

More than half of those surveyed plan to buy a sofa or sectional in the next several months, and six of 10 of those consumers are seeking a fabric sofa. Meanwhile, sectionals were favored by about a third of those surveyed and skewed more heavily toward millennials and higher-income consumers.

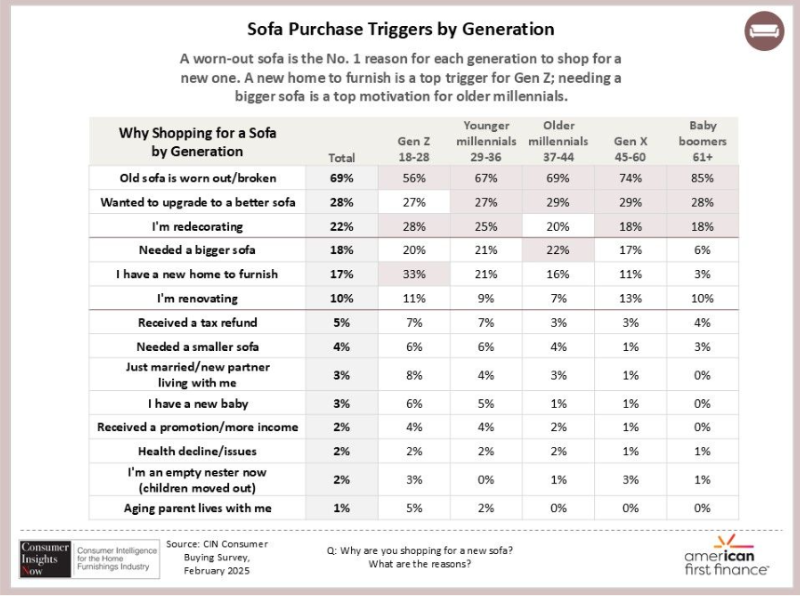

The survey also highlights important details about what triggers the need for a new sofa. For example, 69% said their existing sofa is worn out and needs replacing, followed by 28% who said they want to trade up to a better quality sofa.

This was followed by 22% who said they were redecorating and 18% who said they needed a bigger sofa and 17% who said they had a new home to refurnish. The numbers get smaller from there, with 10% saying they are renovating, 5% saying they got a tax refund and 4% saying they need a smaller sofa, for example. More drivers can be seen in the graphic below.

As with planned sofa purchases, the percentages of those wanting a sectional skewed higher toward younger consumers, ranging from 30% of older millennials ages 37-44, to 31% of those ages 18-28 and 33% of those ages 29-36, compared with 29% of Gen X consumers ages 45-60 and 20% of Baby Boomers over age 61.

Also, 27% of those surveyed who are shopping for a new sectional live in a new house. This compares with 51% of sofa shoppers who have bought a new home in the past six months and 71% who plan to buy a new house in the next six months.

Comments shared by consumers included statements such as “I like the idea of a sectional sofa that can be arranged based on my living space” and “You can use a sectional in many different ways.” Others said, “It makes the most of my new space,” and “I love a sectional because it is so comfortable and roomy.”

Motion sofas were preferred by 43% of those surveyed and skewed more heavily toward younger and older millennials and Gen Z consumers. Overall, some 39% of those surveyed preferred a stationary sofa, with a higher percentage — 54% — of baby boomers favoring this option.

Other key takeaways include how much people plan to spend for a fabric and leather sofa. For example, 37% of those surveyed said they plan to spend $800 to $1,499 for a fabric sofa compared with 33% who said $500 to $799, 16% under $500 and 14% over $1,500.

On the leather side, 33% said they plan to spend $1,400 to $1,999, and 32% plan to spend $900 to $1,399. Some 25% said they plan to spend more than $2,000, and 10% said less than $900.

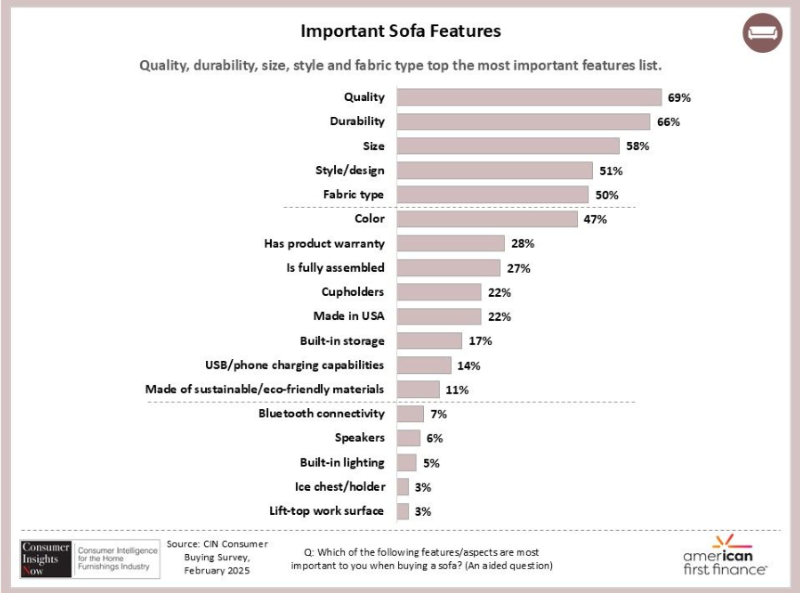

In order, quality, durability and size were important factors for 69%, 66% and 58% of those surveyed, compared with other features such as style/design and fabric, which were key for 51% and 50% of those surveyed respectively.

Other key factors were color, 47%; product warranty, 28%; is fully assembled, 27%; cupholders and built-in storage, 22% and 17% respectively; and USB, phone-charging capabilities, 14%. Made in USA is preferred among 22% of those surveyed.

The good news for retailers is that most consumers planning to buy a sofa or sectional want to do so in the store. Some 74% of those surveyed, for example, said they preferred to buy in-store versus 26% who said online. Baby boomers, Gen X and older millennials are among those more likely to buy in-store, as are homeowners and those making over $100,000 and those making between $50,000 and $99,000 a year.

This compares to the online shopper including Gen Z, younger millennials, renters and those making under $50,000.

Regardless of the age, income or demographic, brick-and-mortar stores have an opportunity to capture these consumers with both in-store and online sales through their own e-commerce platforms.

We hope this data helps provide a deeper insight into consumer preferences and what they plan to spend moving forward. As always, the key to success for any business is having information in hand to pave a path forward.

Below is the publication schedule for this season’s Consumer Insights Now. Deeper dives will follow for the next several weeks on these and other subjects with the following publication schedule:

+ March 24 – Survey of new homeowners.

+ April 7 – Sofa shopping trends.

+ April 14 – Case goods shopping trends — primary bedroom and dining furniture.

+ April 21 – Mattresses for primary bedroom.

+ April 28 – High-end furniture shoppers and design report.