Younger consumers represent the largest percentage of those who are looking to invest in their first home

HIGH POINT — The furniture industry will be glad to know that a significant number of people, including millennials, are among the largest demographic that has recently purchased or is planning to buy a new home in the next six months.

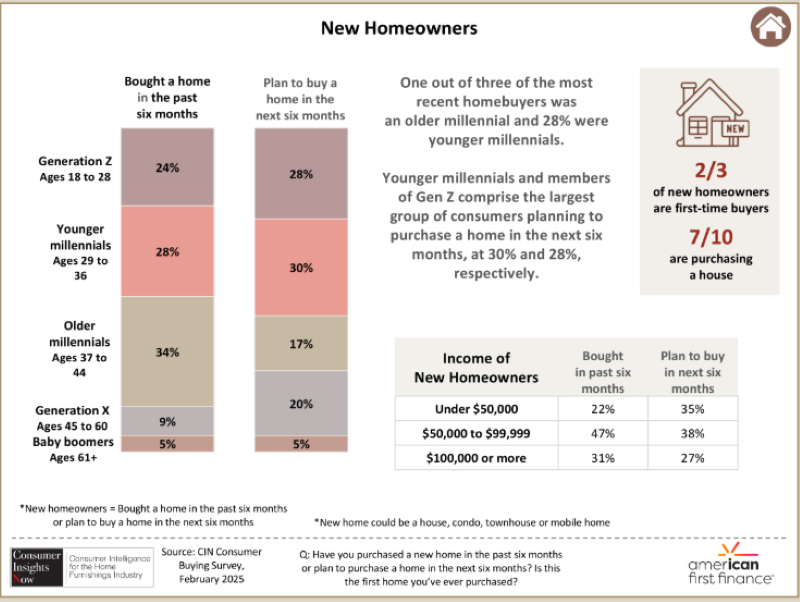

According to our latest round of Consumer Insights Now research sponsored by American First Finance and to be published starting this Monday one out of three of the most recent homebuyers was an older millennial and 28% were younger millennials. Also, younger millennials and members of Gen Z comprise the largest group of consumers planning to purchase a home in the next six months, at 30% and 28%, respectively.

Two out of three overall consumers surveyed are also first-time home buyers and 64% of those plan to buy an existing home compared to 36% who want new construction. Overall, 32% are looking for new construction compared with 68% looking for an existing home.

These are some of the findings in our latest round of Consumer Insights Now, in which industry research expert Dana French asked some key questions relating to what consumers are looking for as they buy a home. It’s the first research of its on the home-buying process the industry has seen in recent memory and one that we believe will provide another window into consumer behavior and what it means for the industry in the months ahead.

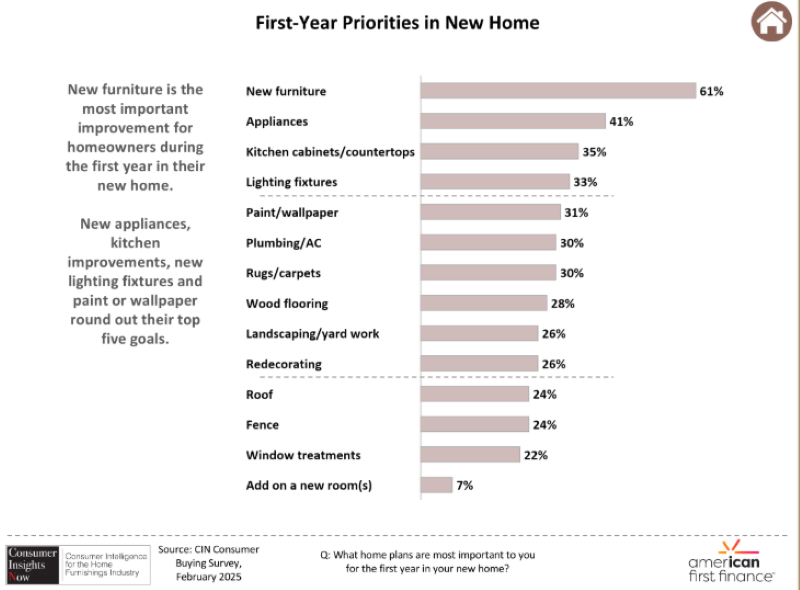

Another key factor that will continue to drive business in the year ahead? Furniture is the No. 1 investment that people plan to make during their first year in their new home.

While this may seem like an obvious, we can’t take it for granted given other competing areas for consumer spending ranging from vacations to automobiles.

But since we specifically are talking about buying a new home, we’re also talking about purchases for the home. And for millennials and other consumers, furniture was the No. 1 priority among 61% of those surveyed, followed by appliances, 41%; kitchen cabinets and countertops, lighting fixtures 33%; and paint and wallpaper, chosen by 31% of those surveyed.

Following in the balance of the Top 10 priorities were plumbing/HVAC and rugs and carpets, 30% respectively; wood flooring, 28%; and landscaping and yardwork, and redecorating, each at 26%.

Furniture was also the top spending priority across age groups, ranging from 56% of Gen Z consumers up to age 28 to 68% of Gen Xers ages 45 to 60 and everyone in between, including 58% of younger millennials ages 29 to 36 and 71% of older millennials ages 37 to 44.

Only 41% of baby boomers ages 61 and up identified new furniture as their top spending priority for their new home. Yet half of those surveyed in that age group identified lighting fixtures, rugs and carpets and landscaping/yardwork as bigger priorities.

Other areas the survey addresses include the income levels of new homeowners, the cost and size of home that different age groups have purchased or plan to purchase and the types of furniture they plan to buy for their new home.

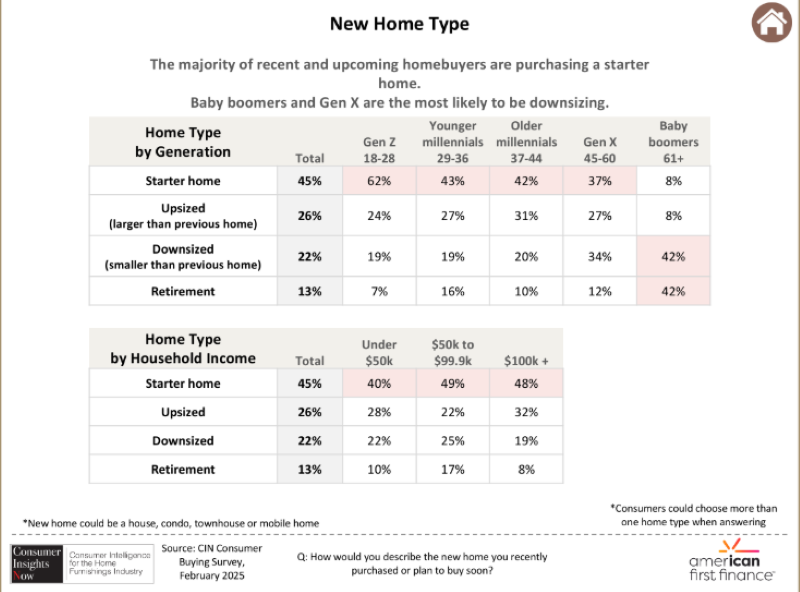

It is also worth noting significant preferences by age group. For example, a majority of people across age groups are buying a starter home, followed by a larger home, then finally a smaller home that represents their needs as they downsize.

Overall, 45% said they plan to buy a starter home, followed by 26% who said an upsized home, 22% who said a downsized home smaller than their previous home and 13% who identified a retirement property. As expected, baby boomers and Gen X consumers were the largest groups (42% respectively) who plan to downsize.

Another key takeaway is that 45% across income levels ranging from under $50,000 to over $100,000 are planning to buy a starter home, compared with 26% planning to upsize, 22% looking to downsize and 13% looking for a retirement community.

Also, the largest number, 38%, said their preference was a home between 1,000 and 1,999 square feet, followed by 31% who said a home between 2,000 and 2,999 square feet, 14% who said a home between 3,000 and 3,999 square feet and 9% who said a home under 1,000 square feet. And 33% respectively said they were comfortable with homes priced from $100,000 to $299,000 and $300,000 to $499,999.

These are just some of the key takeaways from the latest iteration of Consumer Insights Now.

Also key in the findings? Six out of 10 consumers wanting to buy a new home in 2025 say they’d be more likely to purchase if rates were around 5%. The national average for a 30-year fixed mortgage was 7.0% when consumers answered this survey.

In addition, the survey looks at things like the specific types of furniture people plan to buy for their new homes and how many would like to work with an interior designer.

Deeper dives will follow for the next several weeks on these and other subjects with the following publication schedule:

+ March 24 – Survey of new homeowners.

+ April 7 – Sofa shopping trends.

+ April 14 – Case goods shopping trends — primary bedroom and dining furniture.

+ April 21 – Mattresses for primary bedroom.

+ April 28 – High-end furniture shoppers and design report.