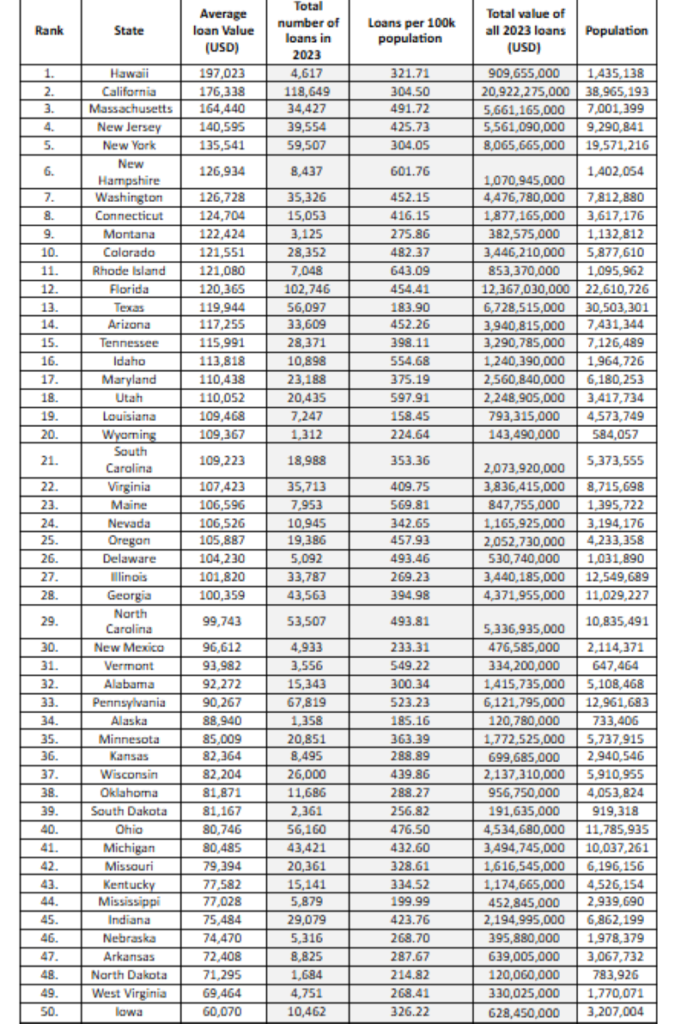

Hawaii and California rank high on survey, followed by Massachusetts, New Jersey and New York in the Top 5

PORTLAND, Ore. — Research by a real estate firm based here offers a window into which states are spending the most on home improvement projects.

The study was conducted by Portland Real Estate and analyzed 2023 home improvement loan data from the Consumer Financial Protection Bureau, which was the latest full year worth of data available. This data showed the states that had the highest and lowest average loan amounts for various projects.

Such projects can be anything from flooring and roof replacements to the addition of new counters, cabinetry and plumbing to name several key areas where consumers spend. Or it could be a disaster-related project that is refurbishing an area of the home damaged by a hurricane or tornado, for example.

Spending on new furniture may occur with various improvements such as the conversion of a bedroom to a home office or the addition of a sunroom or dining area, depending on the nature of the project.

The amounts are impressive to say the least, which indicates that there may also be a budget for furniture. Or perhaps not, as many could be tapped out based on the total loan amounts.

The survey identified Hawaii as the state where consumers are spending the most on home improvements. For example, it said that in 2023, residents there took out $909.7 million that spanned some 4,617 disbursements for an average loan value of $197,023. Hawaii also received 321.71 home improvement loans per 100,000 people.

California, as expected, also ranked high in the survey, coming in second, with consumers taking out an average of $176,337 for each home improvement loan, as residents received $20.9 billion in funds that year, which spanned 118,649 borrowers, also translating into 304.5 loans per 100,000 residents.

Also in the Top 5 were Massachusetts with an average home improvement loan of $164,440, or 491.72 loans per 100,000; New Jersey, with an average loan of $140,594, or 425.73 per 100,000; and New York, with an average loan of $140,595, or 304.05 per 100,000.

Others in the Top 10 included New Hampshire at $129,934; Washington, $126,728; Connecticut, $124,704; Montana, $122,424; and Colorado, $121,551.

Those in the bottom 10 included Iowa at $60,070, or 326.22 per 100,000; West Virginia, $69,464, or 268.41 per 100,000; North Dakota, $71,295, or 214.82 per 100,000; Arkansas, $72,408 or 287.67 per 100,000; and Nebraska at $74,470, or 268.7 per 100,000.

Others rounding out the states in the bottom 10 in terms of home improvement spending included Indiana, at $74,484; Mississippi at $77,028; Kentucky, at $77,582; Missouri, at $79,394; and Michigan at $80,485.

Note that states such as Florida and North Carolina (ranking at No. 12 and 29 respectively) which suffered major hurricane damage this past year, may rank higher in future surveys as homeowners there spend money on various projects to repair such damage.

“Research shows that home improvement sales in the US amounted to $544.6 billion in 2022, further projected to reach $600 billion by 2027,” a spokesperson for Portland Real Estate said. “This study highlights the states that are driving the growth in the home improvement market across the country.

“The data not only highlights the varying levels of investment in home improvements across the states but also underscores the influence of local economic conditions and housing market dynamics. As we see substantial spending in states with higher property values, it’s clear that homeowners in these areas are prioritizing renovations and upgrades as a means to enhance the value and comfort of their homes.”

Regardless of each state’s placement on the survey, those taking on home improvement projects are investing heavily in their homes. It’s the type of work that undoubtedly will increase spending at home improvement retailers such as Home Depot and Lowe’s, which also happen to sell furniture.

Thus, as those retailers offer a one-stop shopping experience for various home improvements, there’s no reason furniture retailers also should not benefit. The data included in this survey simply offers those businesses an idea on how much consumers are willing to borrow to finance what should be considered a further investment in their homes.

Again, as we’ve said in the past, furniture always should be part of that equation now and in the future.