Speaker topics range from bankruptcies to building trust and meaningful relationships with industry partners

RALEIGH, N.C. — Speakers at the Furniture Manufacturers Credit Association Fall Education Conference focused on key issues impacting the home furnishings and accessories supply industry including the competitive advantages of “high-trust, high-performing teams” and a tougher insolvency environment that often results in bankruptcies.

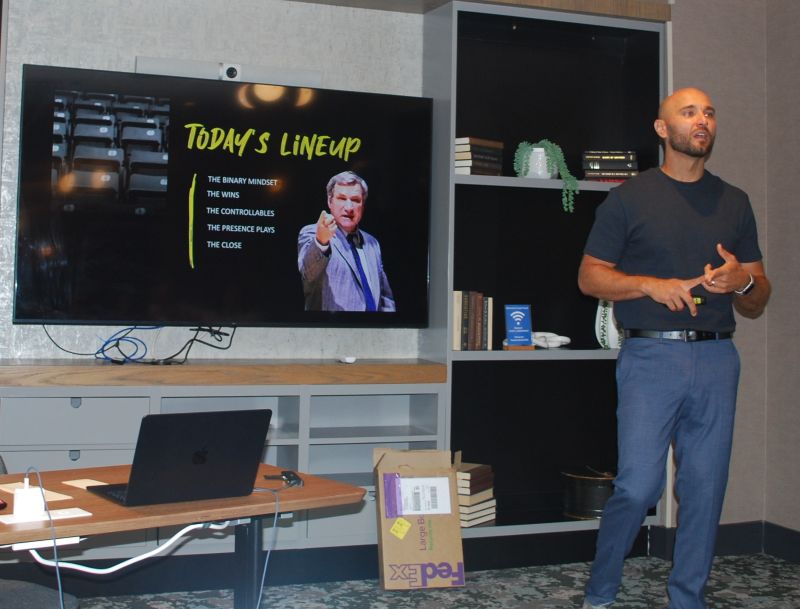

Featured speakers at the event, held Sept. 11-12 at the Hyatt Place in Raleigh, included David H. Conaway, chair of Shumaker’s Bankruptcy, Insolvency and Creditors’ Rights Practice, and keynote speaker Charlie Ruiz, an executive coach and former professional athlete.

Conaway’s presentation, “Strategies and Best Practices for Managing Risk With Financially Distressed Customers and Supply Chain Partners,” focused on factors driving business in the furniture industry, ranging from strong demand for luxury and upscale homes to well-capitalized companies taking advantage of the current business environment to make acquisitions, while “less prepared firms face payroll and financing challenges, lagging on innovation and inventory.”

Addressing an overall increase in bankruptcy filings, he also highlighted doing business with a Chapter 11 debtor as well as a host of Chapter 11 claims and remedies.

“Vendors who are truly critical to a debtor-customer should continue to seek critical vendor status as a means of getting paid,” his presentation noted. “In doing so, vendors should be careful to not violate the automatic stay by conditioning future business on payment of pre-petition debt. Moreover, vendors should be aware that getting paid as a critical vendor will likely be conditioned on providing normal lines of credit, pricing and terms, or other “customary trade procedures.”

Ruiz’s presentation, “Performance Through Presence: Building Sustainable Performance Through Trust and Attention,” focused on helping “leaders to redefine success, build meaningful relationships and create resilient organizations.”

His presentation was followed by a workshop, “Building High-Performance Teams,” that covered key elements of leadership and team dynamics, building trust and the importance of team development.

Day Two of the event kicked off with the presentation of the 2025 FMCA Awards, recognizing members who attend Credit Interchange Meetings, pull FMCA Credit Interchange Reports and use FMCA’s Collection Services. The Top 5 in report usage and Top 5 in collections also receive the award.

Also, the Credit Manager of the Year Award was presented to Curtis Porter of Universal Furniture and special recognition was made to Kristen Burch of Rosenthal Capital Group for her service as Interchange co-chair and Education Committee co-chair.

This was followed by an open industry discussion that included “a practical dialogue on current pay-trend signals, retailer health and how members are tightening terms without blowing up good accounts.”

Also on Day Two was a FMCA Trade Data Review in which members compared verified, industry-specific trade data. The session was a combination of virtual and in-person presentations, “where members shared their factual payment experiences, clarified recent activity and discussed current credit concerns.”

Presented to Kristen Burch (Rosenthal Capital Group) for service as Interchange Co-Chair and Education Committee Co-Chair. Presenter (right) Aimee Shinosky (La-Z-Boy)

The session also highlighted the importance of the following:

+ Staying alert to changes in customer behavior.

+ Interpreting report trends with real context.

+ Asking questions and comparing recent experience — within antitrust guidelines.

+ Making independent credit decisions with better visibility.

“There is no coordination of action — only shared insight and independent judgment,” the session concluded.

by

by

Ron Teglas from FMCA is by far the finest credit manager in our furniture industry. He more than most credit managers really understands sales. If you’re always straight with him he will go the extra mile for you.