Absence of US Department of Commerce retail sales and home construction data during government shutdown shifts our attention to other sources

WASHINGTON — With the ongoing government shutdown, the Department of Commerce has not released two major economic reports that we have typically reported on for many successive months.

These two reports, of course, detail monthly U.S. retail sales and new housing construction activity. We as an industry rely on the retail sales report for a glimpse at furniture store sales activity in the U.S. along with the development of new residential construction, including building permits, housing starts and housing completions.

While it feels odd for us not to be able to report on this specific data from a trusted government resource, there are others that offer a window into retail sales and construction activity.

The first is the National Retail Federation’s Retail Monitor sales report that came out Oct. 9. The report notes that “unlike survey-based numbers collected by the Census Bureau, the Retail Monitor uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions and does not need to be revised monthly or annually.”

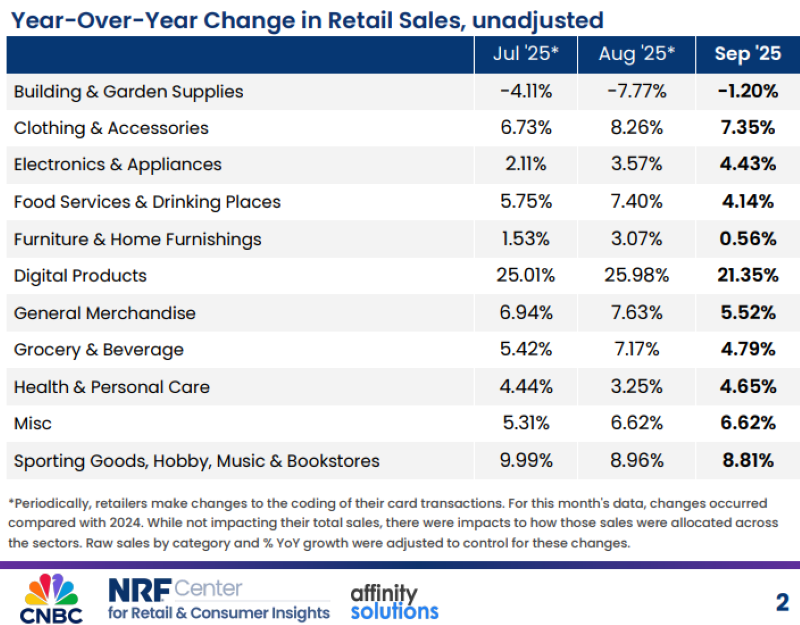

The NRF noted that September sales were up in all but one category – building and garden supplies – on a yearly basis. This was led by digital products, sporting goods stores and clothing stores.

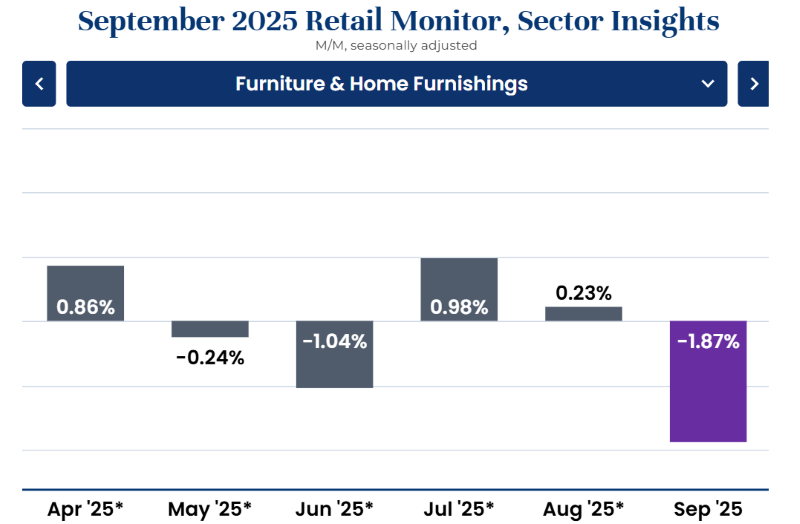

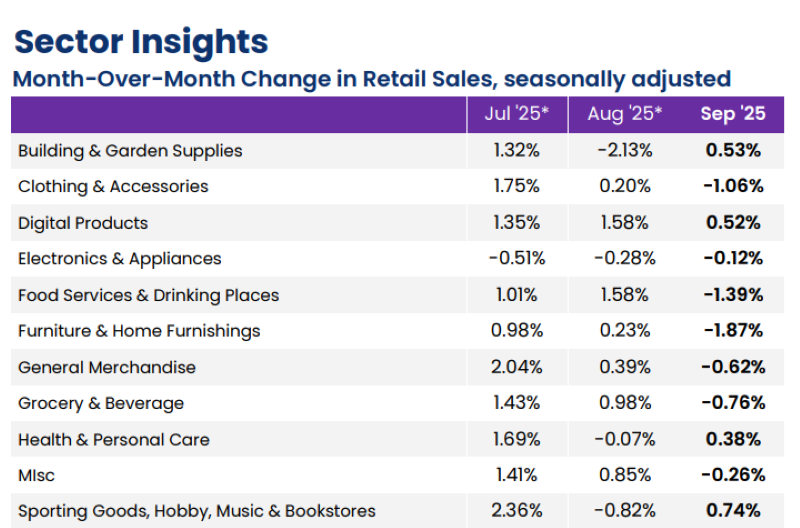

It noted they were down in seven out of nine categories on a monthly basis. This included furniture store sales, which it said were down 1.87% month over month seasonally adjusted but up 0.56% year over year unadjusted.

Total retail sales, excluding automobiles and gasoline, were down 0.66% seasonally adjusted month over month but up 5.42% unadjusted year over year in September, according to the Retail Monitor. That compared with increases of 0.5% month over month and 6.81% year over year in August.

The NRF said that the Retail Monitor calculation of core retail sales (excluding restaurants in addition to automobile dealers and gasoline stations) was down 0.49% month over month in September but up 5.72% year over year. This compares with increases of 0.26% month over month and 6.67% year over year in August, the NRF said.

Other segment activity was as follows, according to the NRF:

+ Digital products (including electronic books and games) were up 0.52% month over month seasonally adjusted and up 21.35% year over year unadjusted.

+ Sporting goods, hobby, music and bookstores were up 0.74% month over month seasonally adjusted and up 8.81% year over year unadjusted.

+ Clothing and accessories stores were down 1.06% month over month seasonally adjusted but up 7.35% year over year unadjusted.

+ General merchandise stores were down 0.62% month over month seasonally adjusted but up 5.52% year over year unadjusted.

+ Grocery and beverage stores were down 0.76% month over month seasonally adjusted but up 4.79% year over year unadjusted.

+ Health and personal care stores were up 0.38% month over month seasonally adjusted and up 4.65% year over year unadjusted.

+ Electronics and appliance stores were down 0.12% month over month seasonally adjusted but up 4.43% year over year unadjusted.

+ Building and garden supply stores were up 0.53% month over month seasonally adjusted but down 1.2% year over year unadjusted.

While September housing start and home completion data also remains unavailable because of the government shutdown, the National Association of Home Builders offered its own assessment of the market based on builder confidence.

It said that builder confidence for newly built single-family homes posted a solid gain in October, rising to 37, up five points from September. This is according to the Oct. 16 NAHB/Wells Fargo Housing Market Index.

Meanwhile, the NAHB noted, future sales expectations were above the 50-point breakeven mark for the first time since January. Any number over 50 indicates that more builders view conditions as good versus poor.

The component measuring current sales conditions rose four points to 38, while the index gauging future sales rose nine points to 54. The gauge charting traffic of prospective buyers rose four points to 25.

The NAHB added that based on three-month moving averages for regional HMI scores, the Northeast rose two points to 46, the Midwest was unchanged at 42, the South increased two points to 31 and the West gained two points to 28.

“While recent declines for mortgage rates are an encouraging sign for affordability conditions, the market remains challenging,” said NAHB Chairman Buddy Hughes, a home builder and developer from Lexington, North Carolina. “The housing market has some areas with firm demand, including smaller builders shifting to remodeling and ongoing solid conditions for the luxury market. However, most homebuyers are still on the sidelines, waiting for mortgage rates to move lower.”

NAHB Chief Economist Robert Dietz described the five-point gain as a positive signal heading into 2026.

“Our forecast is for single-family housing starts to gain ground next year,” he said. “The 30-year fixed-rate mortgage fell from just above 6.5% at the start of September to 6.3% in early October. Combined with anticipated further easing by the Fed, builders expect a slightly improving sales environment, albeit one in which persistent supply-side cost factors remain a challenge.”

He added that based on modeling of historical data, the HMI October increase suggests an approximate 3% increase for the September single-family permit data on a seasonally adjusted annual rate basis.

“Our model suggests a 2% to 4% range for the increase based on the statistical relationship,” Dietz said.

Yet despite the gain, the NAHB said there were some signs of ongoing challenges for the housing market.

For example, it noted that the HMI survey revealed that 38% of builders reported cutting prices in October, which has ranged between 37% and 39% since June. It said the average price reduction rose to 6% in October after being roughly 5% for several months prior. The NAHB said the last time builders reduced prices by 6% was a year ago, in October 2024. In addition, it reported that the use of sales incentives was 65% in October, level with September.