However, there is still concern over tariffs and the impact that could have on prices moving forward

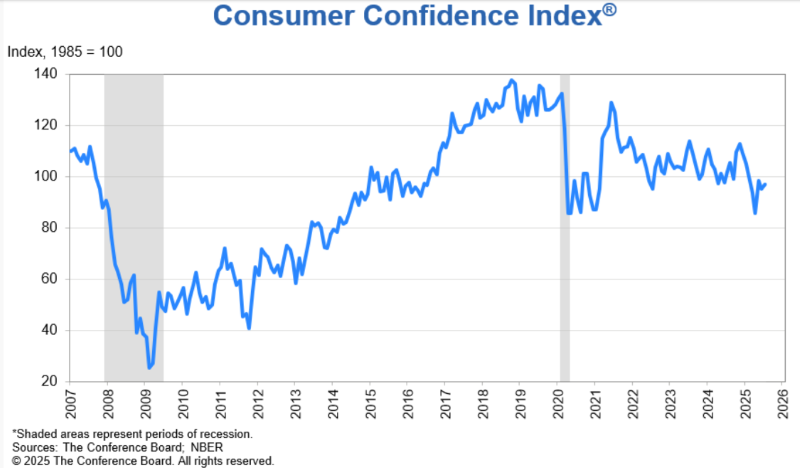

WASHINGTON — Driven partly by the sentiments of consumers over age 35 and those in most income brackets, the Consumer Confidence Index rose two points in July to 97.2 from 95.2 in June, the Conference Board reported Tuesday.

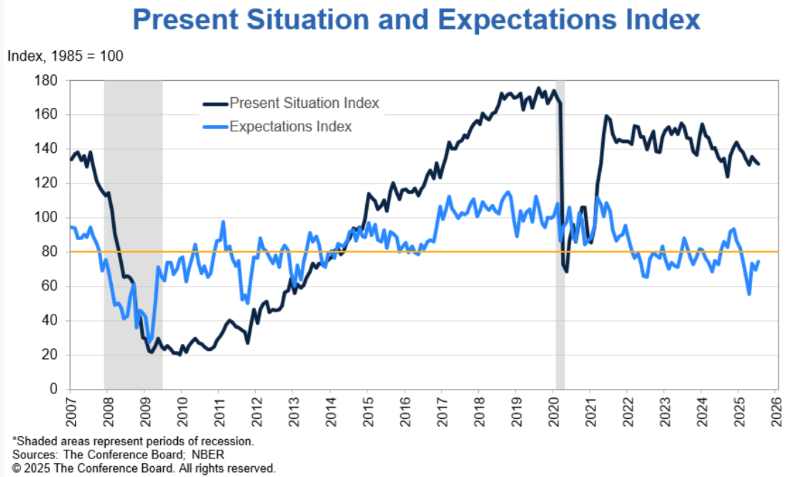

Meanwhile, the Present Situation Index, which reflects consumers’ assessments of current business and labor market conditions, fell 1.5 points to 131.5.

And the Expectations Index, which is based on consumers’ short-term outlook for income, business and labor market conditions, rose to 74.4, a 4.5-point gain.

“Consumer confidence has stabilized since May, rebounding from April’s plunge, but remains below last year’s heady levels,” said Stephanie Guichard, senior economist, Global Indicators at The Conference Board. “In July, pessimism about the future receded somewhat, leading to a slight improvement in overall confidence. All three components of the Expectation Index improved, with consumers feeling less pessimistic about future business conditions and employment and more optimistic about future income.”

“Meanwhile, consumers’ assessment of the present situation was little changed,” he added, noting that consumers were slightly more positive about current business conditions in July than in June. “However, their appraisal of current job availability weakened for the seventh consecutive month, reaching its lowest level since March 2021. Notably, 18.9% of consumers indicated that jobs were hard to get in July, up from 14.5% in January.”

Guichard noted that write-in responses continued to show that tariffs also remained an issue for consumers concerned that they would lead to higher prices. Also, references to higher prices and inflation rose in July even though consumers’ average 12-month inflation expectations dropped slightly to 5.8% from 5.9% in June and a peak of 7% in April.

In the survey, others also mentioned the budget reconciliation legislation passed by Congress. Some were optimistic about its potential positive economic impact, while others voiced concerns, the report noted, adding the “bill and its implications were relatively low on the list of themes consumers were focused on in July.”

Survey responses also showed that consumers’ plans to buy cars and homes declined in July, but were stable on a six-month moving average basis. On a related note, responses to a special question asking consumers about where they feel interest rates are headed showed they believe mortgage rates, auto loan rates and credit card rates were more likely to rise than other types of interest rates, with many expecting credit card rates to rise the most.

That said, the overall share of consumers expecting interest rates to rise declined to 53% from 57.1% in June, while more consumers expected interest rates to fall (21.2% vs 18.4% in June).

In addition, their plans to buy most electronics, with the exception of appliances, rose slightly, while their plans to purchase more services “weakened for a second month, with almost all services categories declining. Dining out remained No. 1 among spending intentions in services. However, dining out also was one of the categories seeing the largest decline in spending intentions in July along with transportation and lodging related to personal travel.”

“Consistent with these findings, vacation intentions were also down overall in the month,” the report said, adding, “Slightly more consumers planned to travel abroad while intentions to travel in the U.S. declined.”

Also in July, consumers’ outlook on stock prices continued to recover a 16-month low in April. Some 47.9% of those surveyed expect stock prices to rise over the next 12 months, up from 37.6% three months ago.

The survey also showed that consumers’ views of their current and future family financial situation “remained solid but deteriorated somewhat in July. The share of consumers expecting a recession over the next 12 months declined slightly in July, but was still above the levels seen in 2024.” The report noted that these measures are not included in calculating the Consumer Confidence Index.

Other highlights of the report were as follows:

Regarding consumers’ Present Situation — including their assessments of current business conditions — were slightly more positive in July.

+ 20.1% of consumers said business conditions were “good,” down from 20.5% in June.

+ 14.3% said business conditions were “bad,” down from 15.0%.

Consumers’ views of the labor market “cooled somewhat in July.”

+ 30.2% of consumers said jobs were “plentiful,” up from 29.4% in June.

+ However, 18.9% of consumers said jobs were “hard to get,” up from 17.2%.

Of their expectations six months from now, “consumers were less pessimistic about future business conditions in July.”

+ 18.4% of consumers expected business conditions to improve, up from 17.1% in June.

+ 23.3% expected business conditions to worsen, down from 24.8%.

Consumers’ outlook for the labor market was “also less negative in July.”

+ 17.5% of consumers expected more jobs to be available, up from 15.9% in June.

+ 25.4% anticipated fewer jobs, down slightly from 25.7%.

Consumers’ outlook for their income prospects was more positive in July.

+ 18.2% of consumers expected their incomes to increase, up from 17.6% in June.

+ 12% expected their income to decrease, down from 12.9%.