Upholstery manufacturers and some metal furniture producers are keeping an eye on global sourcing to maintain pricing and quality

WASHINGTON — The recent doubling of steel and aluminum tariffs to 50% by the Trump administration threatens to raise costs for domestic manufacturers that rely on such materials as part of their product mix.

That includes anyone from upholstery manufacturers to manufacturers of metal beds that import steel or aluminum components for use in their product mix.

These and other domestic resources including wood manufacturers that purchase imported metal components such as drawer glides and hinges are keeping an eye on these costs to help minimize the impact on product pricing.

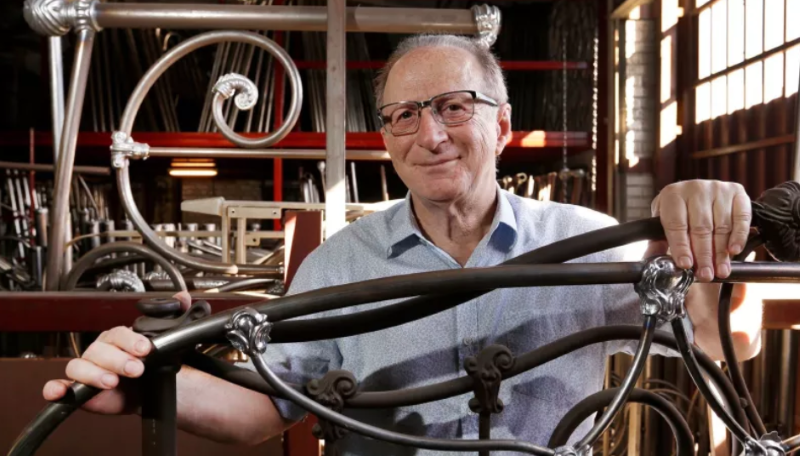

Worthen Furniture, previously known as Brass Beds of Virginia, produces beds from brass and steel and also uses aluminum for various castings. While brass — a mixture of copper and zinc — is not believed to be impacted by the tariffs, other parts of its mix that use steel and aluminum are.

“We buy all our materials from a distributor in the U.S. who buys a lot of our steel tubing from the open market,” company President Doug Rozenboom told Home News Now, estimating that 70% of its product mix uses steel tubing compared with about 30% that uses brass. “And if you think about steel and raw materials like that, it really is a global market, particularly for the materials that get made into things like tubing. Our distributor buys it from Mexico, China and Canada, and there is probably some U.S. steel in there that is made to a certain specification. So when the tariffs hit the price of that material, even material that was in stock pre-tariff went up.”

Rozenboom said this ultimately impacted the pricing of product heading into the April High Point Market, as the initial 25% tariff was in effect since earlier this spring.

To further offset cost increases, the company may soon be buying more of its materials direct, which will help it achieve better pricing on things like steel tubing, for example.

“We are diversifying the source of our raw materials, and we are looking at purchasing direct so I am not paying a distributor price,” Rozenboom noted. “So we would essentially be importing it on our own. And in the process, we are actually searching for a higher-quality raw material that can keep our pricing the same with good sourcing. … We are willing to make a bigger investment in our raw materials to help limit the risk of tariffs being passed on to a distributor, that then get passed on to us.”

While this could require it to carry more inventory of certain items, he noted the results would be positive in that the company could achieve lower pricing and higher quality in the process. The company also aims to divert what it receives from China and focus on other lower-rate source countries.

“We are just having to pivot and make changes based on the volatility,” Rozenboom added. “We are diversifying our supply chain based on the volatility of the tariffs and leveraging our capital to get a higher-quality-based material for our products.”

To avoid tariffs entirely, the company could also use products from a U.S.-based supplier. But like others navigating the materials landscape, that decision also will depend on both quality and price. Construction and quality are particularly important to a company like Worthen, which bends and shapes the steel much like instrument makers that bend materials for wind instruments.

“If it doesn’t meet our specs, it doesn’t matter where it is made,” Rozenboom said.

Up to this point, upholstery producers have largely been focused on tariffs impacting China-made fabrics and yarns as those are a key raw material used on their sofa, chair and sectional frames. But now they are also paying close attention to the costs of things ranging from swivel bases, recliner mechanisms and metal fasteners to springs, sleeper mechanisms and even decorative metal nail-head trim.

Upholstery manufacturer Southern Motion is currently receiving guidance on what specific items are covered by the tariffs, including steel seating mechanisms, along with metal swivel bases and components for sleepers.

It also is trying to limit its exposure on materials sourced directly from China, which still faces a 30% tariff on other materials including yarns and fabrics, down from 145% previously

“One of the big things we are trying to do is resource all that out of China — where at a minimum it is 30% — to somewhere else in Asia, which is still subject to the 10%,” said Mark Weber, president and chief executive officer. “It is still a lot better than the 30% and certainly better than the 145%. Basically it didn’t make sense to buy anything from there.”

He also noted that the company is using motors for its motion line that use different materials than aluminum, thus avoiding the 50% tariff on aluminum parts.

Stationary upholstery manufacturer Craftmaster Furniture is also keeping an eye on its supply chain, noted Alex Reeves, president. He pointed out that the steel tariffs could impact the pricing of imported materials such as springs, staples, glider and swivel bases, recliner mechanisms, sleeper mechanisms, decorative nails, casters and connectors.

“We are a domestic manufacturer with a lot of imported components,” he said.

Thus, the company is doing what it can to keep prices down.

“We will increase pricing as little as possible,” Reeves said, noting that the company had its typically seasonal price increase this past April that was slightly higher than usual in this tariff environment. “We are absorbing a lot and we run on very tight margins. … That is what our niche is. We are focusing on quality and creating more value.”

He added that the company continues to diversify its sourcing to get the best price on such materials. Still it’s a balancing act as the company has certain specifications necessary to maintain the quality its customers expect.

“We are always doing that, Tom,” he said of the process. “But the thing about it is that we have to have quality, too. We just can’t sacrifice the quality with a cheaper price and a cheaper product. It’s just not going to cut it. Our big thing is quality first, then speed of delivery. That is kind of how we roll.”

“I think that the research and the movement and the due diligence to shift our sourcing of supplies, materials and components has helped, but there is only so much you can do,” he added. “It’s a fast-moving train.”

Not every domestic producer has been susceptible to the steel tariffs. For example, metal beds and dining table and chair/barstool specialist Wesley Allen has used its domestic metal supplier for the past 40 years and continues to do so, thus avoiding the 25% to 50% tariffs.

“The reason we say Made in the USA and we are perfectly OK with it is that our metal and raw materials come from the U.S.,” President Victor Sawan told Home News Now, noting that aluminum it uses for castings also come from a domestic resource. “We have not changed our supplier. Even our cardboard boxes, everything comes from the U.S. It doesn’t make sense for us to buy the stuff from overseas.”

A big reason for that, he said, is to avoid having to deal with quality issues from afar. The domestic supplier is about 40 miles away from its Los Angeles area headquarters compared to some 1,400 miles across the ocean to the Guangdong Province, for example.

“And if I had a quality issue, I would have to jump through hoops to get it fixed,” Sawan said. “These folks (domestically) are at the factory twice a month and they look at the product and check it. They make the metal to our specifications and that’s what we want. We want something to our specifications. … It’s the same thing with cardboard, the same thing with aluminum. I do it because it’s convenient, and the quality is good.”

One area where the company is affected by tariffs is with China-made fabrics for its upholstered headboards and footboards. But even with pricing pressure with these fabrics and some general cost increases on domestic metals, Sawan said he has not had to pass along a price increase to its customers of late.

“I want to see where this thing goes before I do a price increase,” he said, of the up-and-down nature of tariffs. “We have faced price increases, but we have not passed it along because I don’t want to raise prices today, lower them tomorrow and then increase prices the day after tomorrow. I don’t want to do that. I want to see where the dust settles.”

Boone, North Carolina-based Charleston Forge manufactures furniture with mixed-media elements including metal bases for tables, benches, consoles and wine racks and metal frames for etageres, display units, chairs and beds, for example. However, while it sources a small amount of steel from Canada, it mainly uses a domestic supplier, which is located in Hickory, North Carolina, roughly an hour south of its plant in Boone.

“We have been blessed to not be affected by the tariffs at all,” said company President Dan Minor of the steel and aluminum tariffs, adding that as a result, the company also hasn’t had to raise prices. “None of our steel is coming from China, Europe or anyplace like that. Most of it is coming from the States.”

He noted that the company also has not seen any cost pressures from its domestic supplier in Hickory which gets the raw steel from a variety of sources, adding, “We have been pretty blessed with that.”

In addition, he said, other raw materials used in its mix including wood and glass for tabletops, are also domestic, which helps it further avoid any direct impact from tariffs.

“We have tried to pride ourselves on being an American-made company, with the vast majority of our supplies and parts coming from within a 90-mile radius of our plant. So it’s been good for us. It was also good at (the April High Point) Market to be able to not have to have tariff conversations.”

However, these indeed are rare examples of domestic producers not having to rely on an overseas supply chain.

Thus, because of the global mix of materials others — ranging from upholstery manufacturers to metal beds suppliers — use in their mix, the subject of tariffs on steel and anything else they import likely will remain top of mind for the foreseeable future.