However, company maintains strong balance sheet, reporting $9.9 million in adjusted net income and $183 million in cash and investments with no outstanding debt

DANBURY, Conn. — Retailer and manufacturer Ethan Allen reported a 2.5% drop in sales for its fiscal third quarter ended March 31.

Total sales for the quarter were $142.7 million, compared with $146.4 million the same period last year. It reported wholesale net sales of $99 million, compared with $89.8 million the prior year, and retail net sales of $117.6 million, compared with $122.6 million the prior year.

The company remains profitable with $9.9 million, or 38 cents per share, in adjusted net income, compared with $12.4 million, or 48 cents per share, the same period last year, a 20.4% decrease.

Its gross profit for the quarter was $87.4 million, representing a gross margin of 61.2% compared with gross profit of $89.8 million, or 61.3% in gross margin last year.

Other highlights of the third-quarter report are as follows:

+ The company reported that wholesale segment written orders declined 11.2% and retail segment written orders decreased 13%.

+ It also reported an operating margin of 7.7% and an adjusted operating margin of 8% compared with 10% last year.

+ Inventory levels totaled $150.4 million as of March 31, up $8.3 million since June 30, 2024.

+ It generated $10.2 million in cash from operating activities compared with $23.7 million the prior year.

+ Advertising expenses were equal to 3.4% of consolidated net sales, consistent with a year earlier.

+ The company paid cash dividends totaling $10 million or $0.39 per share, up 8.3% from a year ago

+ It also said it ended the quarter with $183 million in total cash and investments with no outstanding debt.

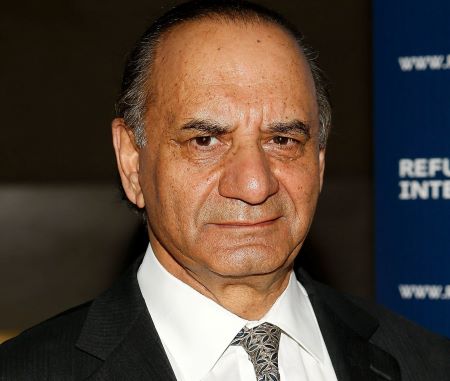

“Our vertically integrated enterprise, including our interior design retail network, relevant product offerings and ability to manufacture about 75% of our furniture in our own North American facilities, has provided us a strategic advantage,” said Farooq Kathwari, chairman, president and chief executive officer.

“We are pleased with our third-quarter results, which produced a strong gross margin, positive operating cash flow and total cash and investments of $183 million with no outstanding debt. These results reflect our ability to operate in an industry faced with reciprocal and retaliatory tariffs, uncertainty in the economy, elevated interest rates and a challenging housing market, that together, have impacted consumer confidence and interest in the home.”

He added that the company continues “to strengthen various areas of our enterprise, including our talent, product offerings, marketing, retail network, manufacturing, logistics, technology and social responsibility. We are thankful for the continued hard work and support of our 3,294 talented and dedicated associates, who have greatly benefited from ongoing investments in technology and helped us lower headcount by 35.7% since 2019. We look forward to continued progress and remain cautiously optimistic.”