Upholstery remains a top area of consideration, but consumers also have their sights set on wood furniture categories such as bedroom, home office and occasional

HIGH POINT — In our latest Consumer Insights Now research published earlier this week, we identified sofas and primary bedroom as among the top categories that consumers purchased in the first half of the year. Not surprisingly, they also turned up as top categories that consumers plan to buy for the remainder of the year through December.

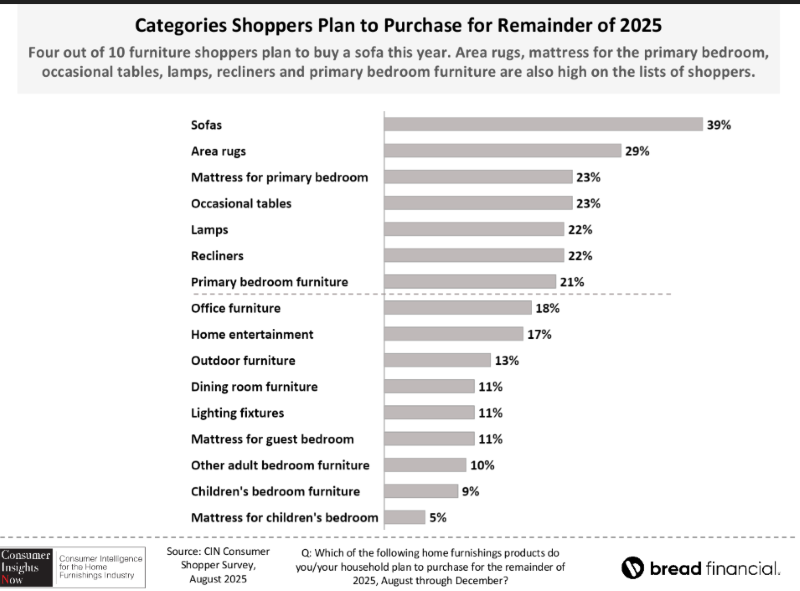

Sofas were the No. 1 product sought by consumers, with 39% of those surveyed planning to purchase the category between August and December. This was followed by 29% of those surveyed seeking to buy an area rug, 23% seeking a mattress for the primary bedroom and occasional tables, respectively, and 22% each planning to buy lamps and a recliner. Twenty-one percent of those surveyed planned to buy primary bedroom followed by 18% that plan to buy home office.

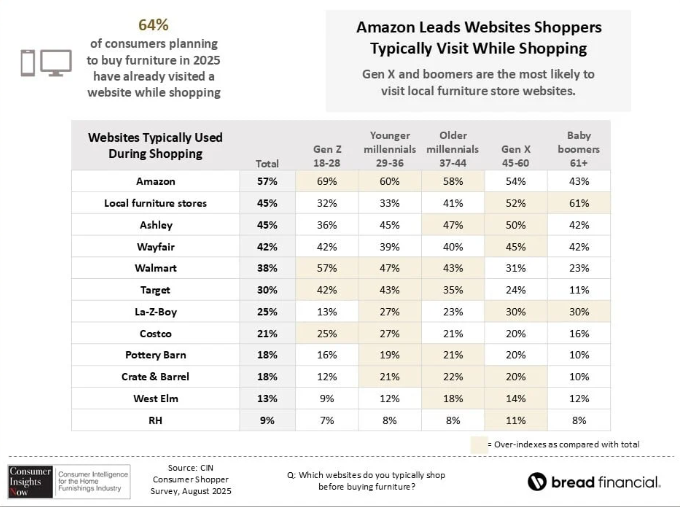

A key takeaway is that most consumers begin their search online. Some 64% of those surveyed said they visited a website, and of those, 57% said they visited Amazon, followed by 45% who said they shopped the website of a local store or Ashley. This was followed by Wayfair, 42%; Walmart, 38%; Target, 30%; La-Z-Boy, 25%; Costco, 21%; Pottery Barn and Crate & Barrel, 18%; West Elm, 13%; and RH, 9%.

Also worth noting as seen in the slide below is that 51% visited a physical store to view their options, a stat that includes older millennials ages 37-44 and Gen X ages 45-60 at 57% and 52% respectively. The chart also shows that four out of 10 consumers have determined what they want to spend and 40% also said they have browsed social media, websites and magazines for inspiration.

Even more revealing are the attributes consumers are seeking in major categories such as upholstery and bedroom. For example, 99% of those surveyed said the sofa must be comfortable, followed by 98% that said it must be the size they want, 97% who said it must be the color they want and 96% who said it must be easy to clean. Some 84% said that it must also come with a warranty and 78% said it must last for roughly 15 years. This was followed by 74% who said it must be fully assembled and 69% who said it must be made in the U.S.

Of the construction details, 88% said it must have performance fabric, 78% said it must simply be fabric, 68% said it must be stationary and 58% said it must have motion functionality. Another 57% said it must be made with eco-friendly materials and 32% said it must be leather. Other important features included cup holders (42%), USB and phone-charging capabilities (41%), Bluetooth connectivity (23%), built-in lighting (21%) and speakers (20%).

Twenty-seven percent said the sofa should be under $500, 48% said under $1,000 and 77% said under $2,000.

Readers also will be interested to learn that 92% said the seating should have positive online reviews, free delivery (87%), easy to return (80%), be able to sit on it in the store (80%), the retailer offers in-home set-up (69%), made by a brand or manufacturer I know (65%) and sold by a retailer I already shop with (57%).

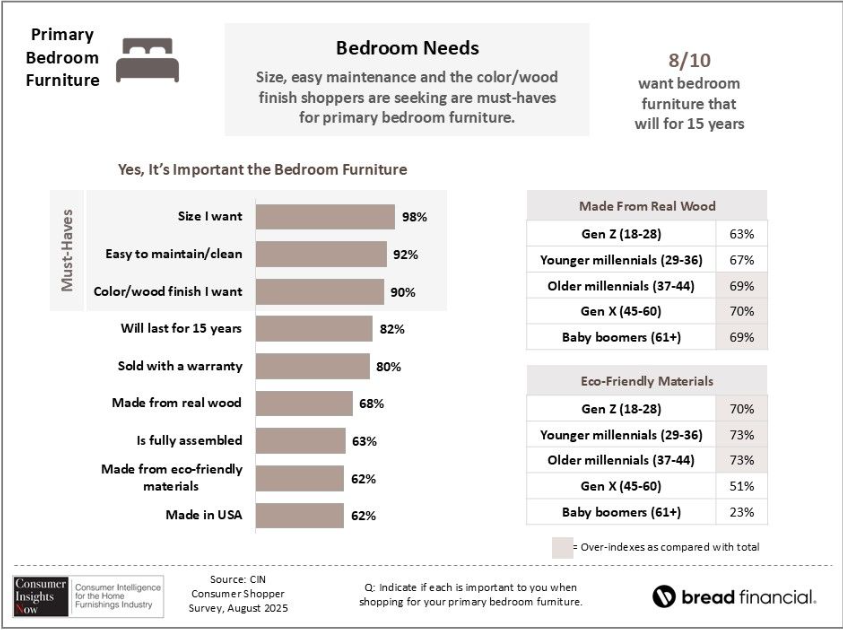

Of primary bedroom furniture, 98% said it should be the right size, 92% said easy to maintain and clean, 90% said it should come in the right color or finish and 82% said it should last for 15 years. Eighty percent said it also should be sold with a warranty, 68% said it should be made with real wood and 63% said it should be fully assembled. Sixty-two percent said it should be made with eco-friendly materials, the same percentage that also said it should be made in the U.S.

Other important features included built-in storage (62%), USB/charging capabilities (43%), built-in cup holders (35%), speakers (30%) and Bluetooth connectivity (28%). Some 32% of those surveyed said the bedroom should be under $500, compared with 65% who said under $1,500 and 80% who said under $3,000, leaving 20% of shoppers willing to spend more than $3,000.

Some 91% said it should have positive online reviews, followed by 87% who said the retailer should offer free delivery, 85% who said it should be easy to return, 74% who said they should be able to see and feel it in the store and 68% who said the retailer should offer in-home set-up. Sixty-five percent said that it should be made by a brand or manufacturer they know, while 55% said it should be sold by a retailer where they already shop.

Thus, we see that qualities such as durability, quality and functionality are all important. But so are digital traits such as being able to see online reviews and also the ability to do research about the product online, plus finding out things like dimensions, materials, colors and finishes and, of course, price.

Does your store or website offer this information? And do the bedroom and upholstery lines you offer have these types of features and functionality? If so, then you likely have what many customers in the market are looking for in each segment.

If not, we hope this research helps guide some of your shopping patterns at the upcoming fall High Point Market to make your store more competitive in the marketplace. Because what’s for certain is that customers know what they want and will most likely shop where they can get it.

Below is an overview of this season’s five installments of Consumer Insights Now

+ Sept. 15 – Furniture Shopper Perceptions About the Economy.

+ Sept 22 – The Shopping Journey and Motivators for Consumer Furniture Purchases.

+ Sept. 29 – Needs and Driving Factors for Consumers Shopping for Furniture.

+ Oct. 6 – Buying In Store Vs. Online.

+ Oct. 13 – Motivations and Attitudes of Today’s Consumers.